In an era dominated by digital commerce and remote working, one might wonder if traditional retail spaces still have a role in the modern investor’s portfolio. Interestingly, savvy commercial investors are increasingly drawn to select physical retail spaces—not just any retail space, but those that meet precise criteria offering distinct value propositions. A perfect example lies in the heart of Singapore’s District 12 at Balestier Road: Shoppes @ Ascent 456.

Understanding the Appeal of Retail Investment in 2025

To comprehend who is buying retail today, it’s essential to grasp the contemporary investor mindset. These investors are discerning, focused on acquiring assets that promise consistent foot traffic, strategic location, and resilience to economic fluctuations. Gone are the days when buying retail was merely about owning a physical shop; today’s investor is highly strategic, prioritising locations with enduring commercial vitality and substantial local catchments.

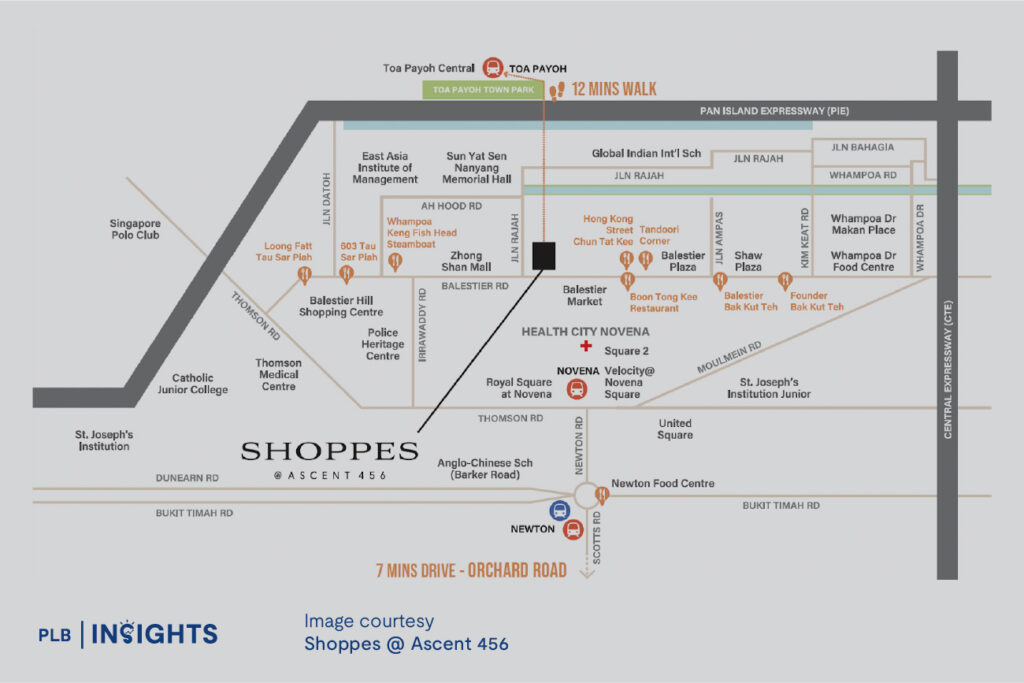

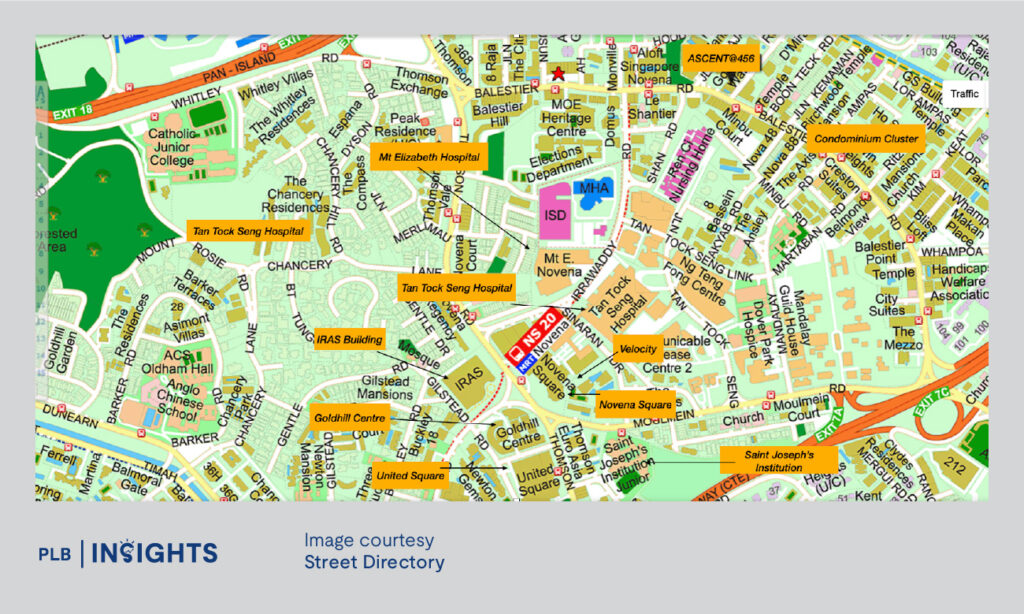

Balestier Road exemplifies this new commercial ethos perfectly. Known historically for its heritage-rich streets and culinary diversity, Balestier attracts both locals and tourists, securing perpetual foot traffic. Furthermore, its proximity to major healthcare hubs like Health City Novena, combined with residential developments, offices, and educational institutions, promises a reliable, diverse consumer base.

The Anatomy of a Winning Commercial Investment: Shoppes @ Ascent 456

Investors purchasing retail units in 2025 are not just buying physical space—they’re strategically aligning themselves with evolving consumer habits and urban development trends. Shoppes @ Ascent 456 meets these contemporary investor demands by combining a prime city-fringe location, enduring freehold status, and versatility tailored for today’s consumer preferences.

Location and Accessibility: Why It Matters

Strategically situated just minutes from Novena and Toa Payoh MRT stations, Ascent @ 456 enjoys excellent visibility and continuous foot traffic. Accessibility is further enhanced by major expressways—PIE and CTE—facilitating quick connections to the Central Business District (CBD) and the Orchard Shopping Belt, a mere 7-minute drive away.

Diverse and Robust Catchment

Investors are astutely aware of the importance of catchment diversity. With over 83,000 residents and 30,000 daily commuters from Novena Health City, Shoppes @ Ascent 456 boasts a robust and steady stream of potential customers. Nearby are 14 educational institutions within a 2-kilometre radius, further enriching the commercial ecosystem.

Freehold Advantage: Long-term Vision

In a market increasingly saturated with leasehold properties, freehold commercial units offer investors peace of mind and long-term capital appreciation potential. Ascent 456’s freehold tenure is a rare find in Singapore, enhancing the property’s appeal to investors keen on preserving and growing their asset’s value indefinitely.

Versatility and Brand Visibility: Tailored for Today’s Businesses

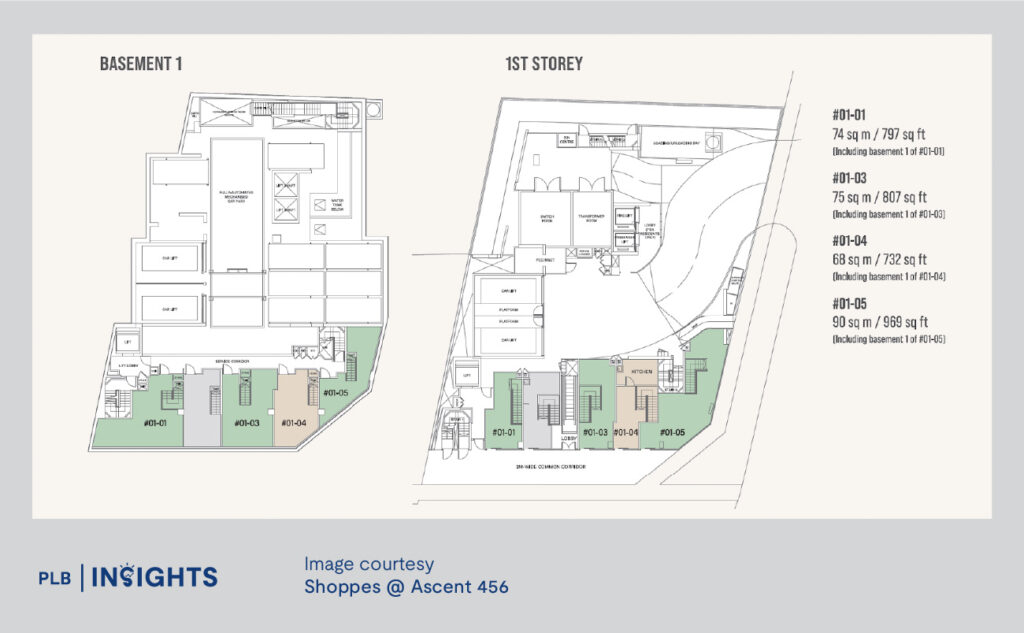

Successful investors in 2025 understand that retail units must offer flexibility—not just in size, but in how space is used. At Shoppes @ Ascent 456, select commercial units come with a rare and valuable feature: dual-level layouts with direct access from both the Basement and Level 1. This isn’t just a novelty—it’s a strategic edge.

Imagine operating your flagship café or concept store on the highly visible ground level, while the lower floor becomes a cosy lounge, workshop studio, or even a revenue-generating rental space. The ability to separate—or integrate—functions across two levels within a single unit empowers business owners to scale, adapt, and maximise returns with minimal friction.

Each unit also includes essential retail-ready features like floor traps and water points, offering plug-and-play convenience for F&B operators, beauty and wellness services, enrichment centres, and medical practitioners. Whether you’re building your brand or leasing for income, these layouts offer spatial and strategic flexibility that’s increasingly hard to find in today’s market.

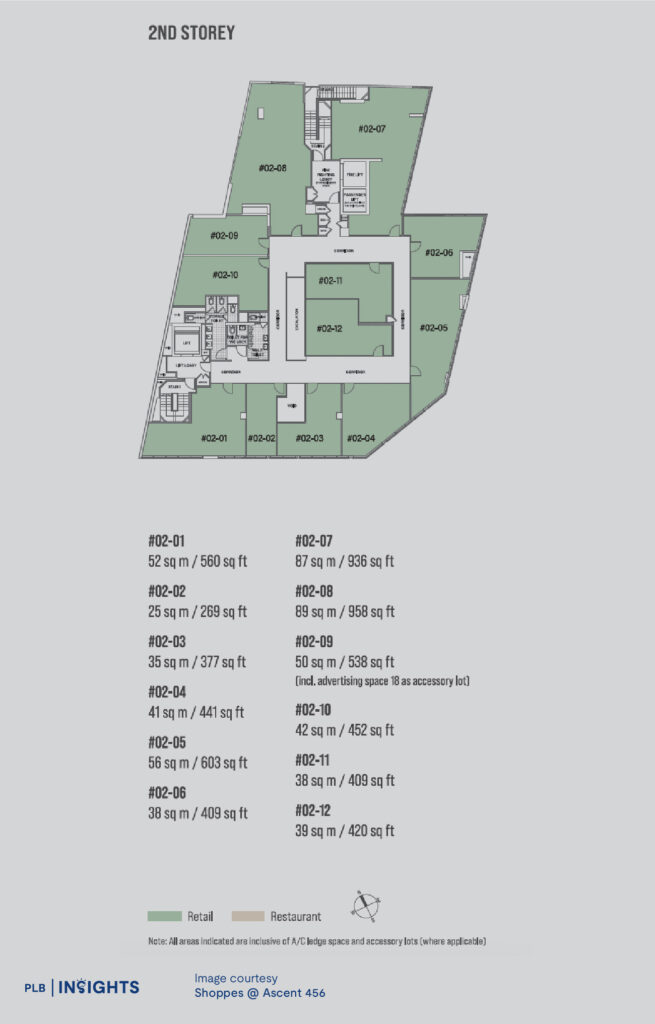

Detailed Overview: Available Units at Shoppes @ Ascent 456

Ground Floor Units

#01-01 (797 sqft, $3,665 psf, $2.921M)

A dual-level layout that maximises space and provides direct access from both basement and Level 1, ensuring high visibility and convenience. Its strategic positioning near the passenger lift makes it ideal for retail or enrichment centres.

#01-03 (807 sqft, $3,672 psf, $2.963M)

Another dual-level unit, prominently located with excellent frontage and ease of accessibility. Perfect for retail businesses, enrichment centres, or service-oriented setups benefiting from a consistent pedestrian flow.

#01-04 (732 sqft, $4,148 psf, $3.036M)

Specifically designed to cater to F&B businesses, featuring a versatile layout optimised for culinary setups. Its position taps directly into Balestier’s renowned culinary scene, promising high customer turnover and excellent branding opportunities.

Second Floor Units

#02-04 (441 sqft, $2,803 psf, $1.236M)

Compact yet highly functional retail space suitable for boutiques, specialised retail outlets, or niche service providers. Its affordable quantum makes it an accessible investment.

#02-06 (409 sqft, $2,768 psf, $1.132M)

Currently tenanted till May 2027 at $3.7K/month, providing immediate stable rental returns. Ideal for investors prioritising instant yield. To understand how this translates into rental yield and future potential, get in touch with our team for a personalised breakdown.

#02-07 (936 sqft, $2,433 psf, $2.277M)

Generous in size, this unit is also tenanted till May 2027 at $7.5K/month, offering substantial and predictable income. It’s suitable for investors seeking larger spaces for established retail or service brands. Reach out to our consultants to explore the yield profile and strategic long-term prospects of this asset.

#02-09 (538 sqft, $3,206 psf, $1.725M)

Features prime facade space and branding visibility, perfect for retailers or service providers who seek to maximise brand exposure and capitalise on high pedestrian visibility.

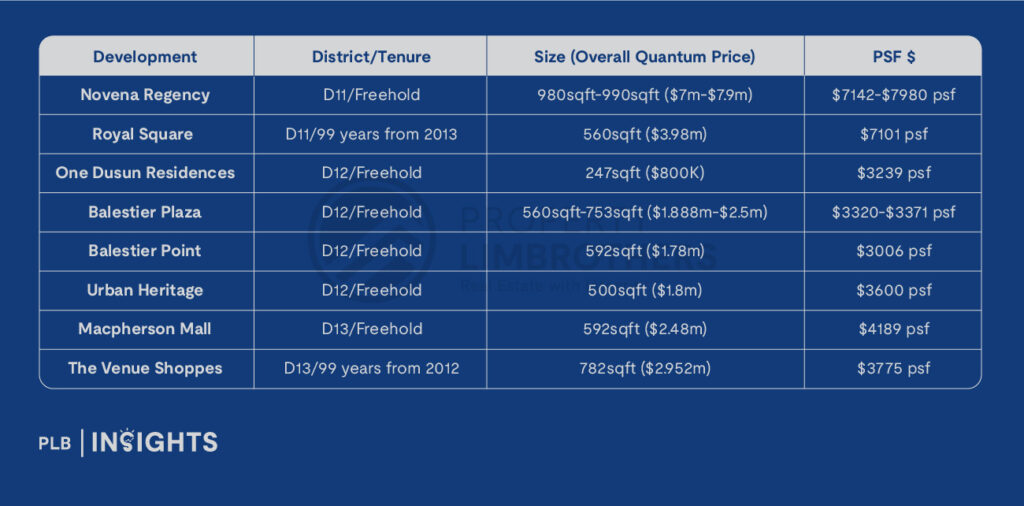

Comparative Pricing and Entry Points: In-depth Analysis

Analysing market comparables, retail units at Shoppes @ Ascent 456 stand out as highly competitive. Here are key comparisons:

With freehold tenure across all units and attractive entry PSFs—some starting from as low as $2,433—Shoppes @ Ascent 456 offers rare affordability in the freehold commercial space segment. For investors seeking to diversify their portfolios into long-term income-generating assets, these units provide both flexibility and future-proof capital appreciation.

Smart Investors See Beyond Short-term Trends

Ultimately, the new breed of commercial retail investor in 2025 is not simply chasing short-term gains. Instead, they meticulously evaluate long-term potential, strategic location, and immediate value propositions, all of which Shoppes @ Ascent 456 comprehensively offers.

Shoppes @ Ascent 456 embodies the future of retail investing: strategic, versatile, and enduring. For those forward-thinking enough to act decisively, the available units present an opportunity not just to participate but thrive in Singapore’s commercial real estate future.

Interested in learning more about the remaining units at Shoppes @ Ascent 456? Whether you’re eyeing immediate rental returns or a long-term freehold asset in a high-footfall location, our consultants can walk you through the numbers, layout options, and strategic potential. Click here to get in touch with our team and take the next step toward securing your spot in one of Singapore’s most promising commercial pockets.