Singapore has a long history of being a welcoming destination for foreign property investors to park their wealth. In recent years, especially on the back of the COVID-19 pandemic, the city-state has emerged as one of the most desirable places in the world to buy property due to its stable political climate, excellent infrastructure, and strong economic fundamentals. This is in spite of the several rounds of cooling measures where the Additional Buyer’s Stamp Duty (ABSD) rates were increased for foreign buyers.

However, buying property in Singapore as a foreigner is subject to certain restrictions and regulations. In this article, we will be breaking down the type of properties foreigners can buy in Singapore and the steps involved in making the purchase. You may also want to check out our previous article about whether foreigners should rent or buy property in Singapore.

Step 1: Understanding the Restrictions and Eligibility Criteria

Who are considered foreigners?

In Singapore, a foreigner is generally defined as any individual or entity that is not a Singapore Citizen (SC), company, society, limited liability partnership (LLP), or association. Under this definition, Singapore Permanent Residents (SPRs) will also fall under the category of foreigners.

Although SPRs are still considered foreigners, they are accorded a more relaxed set of restrictions and regulations.

What type of properties can foreigners buy?

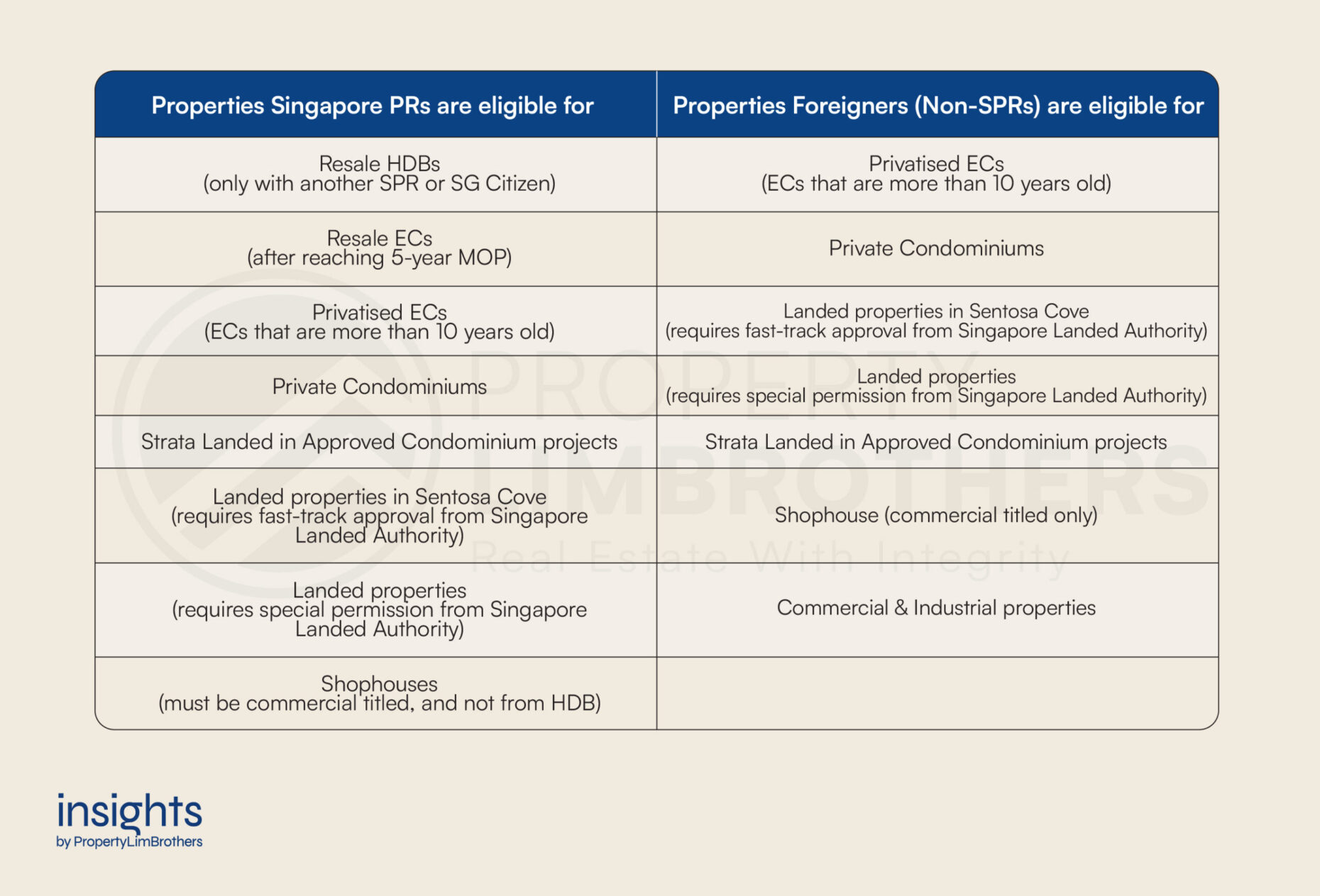

Under the Residential Property Act, foreigners are allowed to own residential properties in Singapore, but with certain restrictions. The biggest difference between a SPR and foreign investor (non-SPR) is that SPRs can buy from both the public and private housing market (subject to eligibility criteria) while the latter can only buy from the private housing market.

The above table summarises what properties SPRs and foreign investors are eligible for in general. However, there are other factors to consider, such as:

- Whether the individual is buying the property alone or jointly with others

- If buying jointly, what are the residency statuses of each buyer?

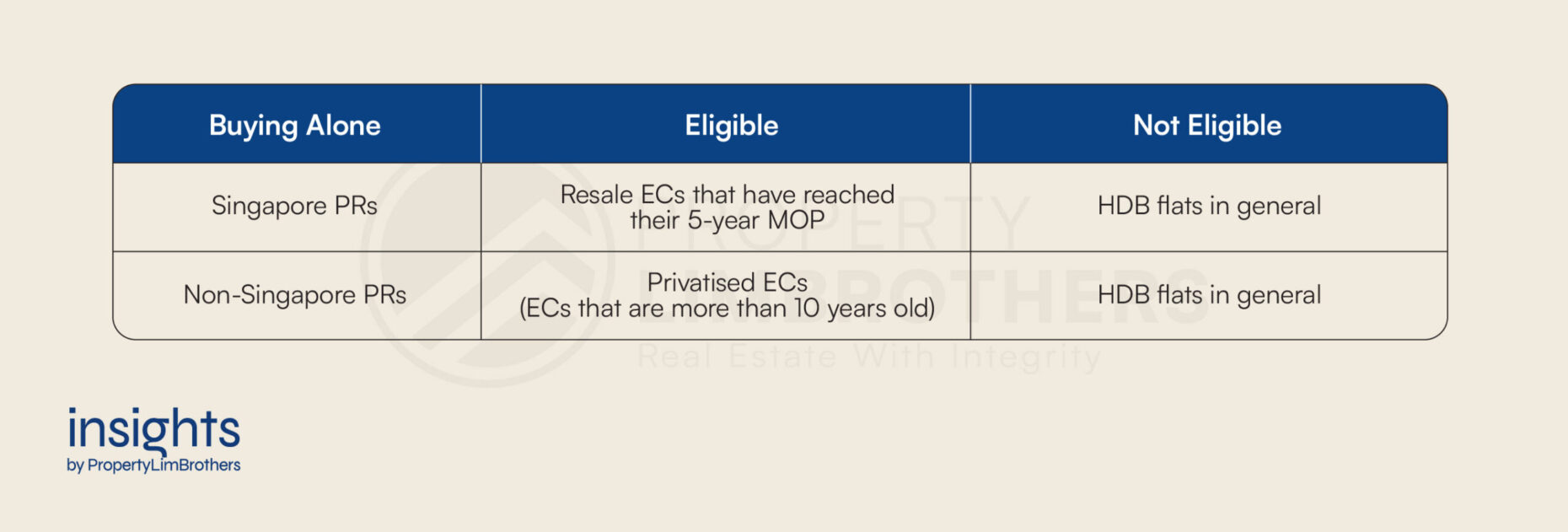

For foreigners buying a property alone, new HDB flats from BTO and SBF exercises will be out of the question as they are public housing set aside specifically for SCs. The only form of public housing SPRs will be eligible for is resale Executive Condominiums (ECs) that have passed their 5-year Minimum Occupation Period (MOP) while foreigners can only buy privatised ECs.

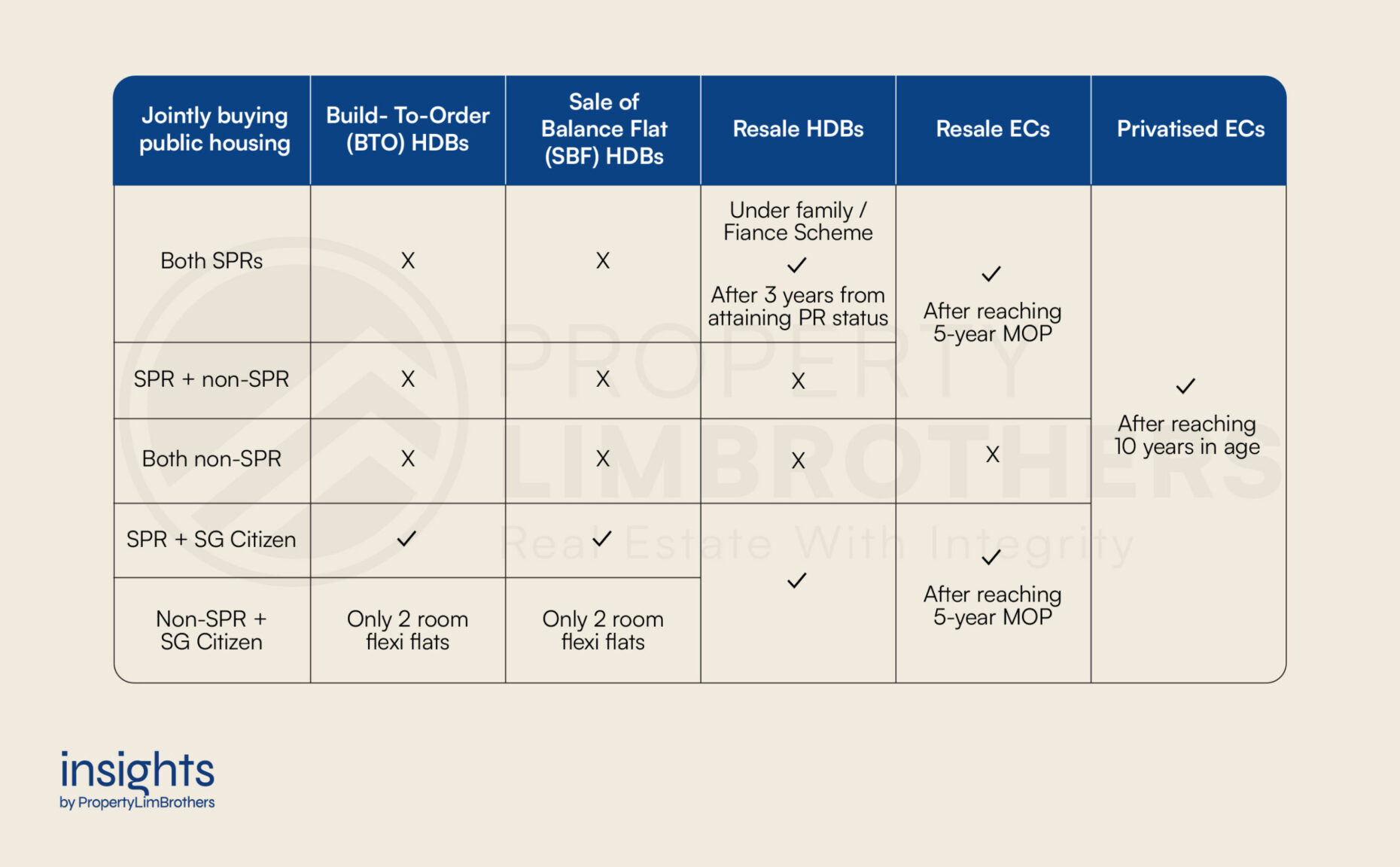

For foreigners buying a property jointly with others, their residency statuses matter. There are varying levels of restrictions that apply to different groups of individuals based on their residency status.

A couple who are both foreigners (non-SPRs) are only allowed to purchase ECs that are more than 10 years old. There are no additional privileges granted.

However, if there is one SPR and one foreigner purchasing the property together, they are permitted to buy resale ECs that have already fulfilled their 5-year MOP as well as fully privatised ECs (more than 10 years old).

A couple who are both SPRs may purchase a resale HDB flat under the Family or Fiancé Scheme, as long as they have held their PR status for at least three years. They may also choose to buy resale ECs that have already fulfilled their 5-year MOP, or ECs that are more than 10 years old.

If a couple is made up of at least one SC, more options are available. A SC and SPR couple can ballot for a BTO/SBF flat, or buy an HDB flat or EC from the resale market. A SC and foreigner couple can also ballot for a BTO/SBF flat but will be limited to only 2-room Flexi flats.

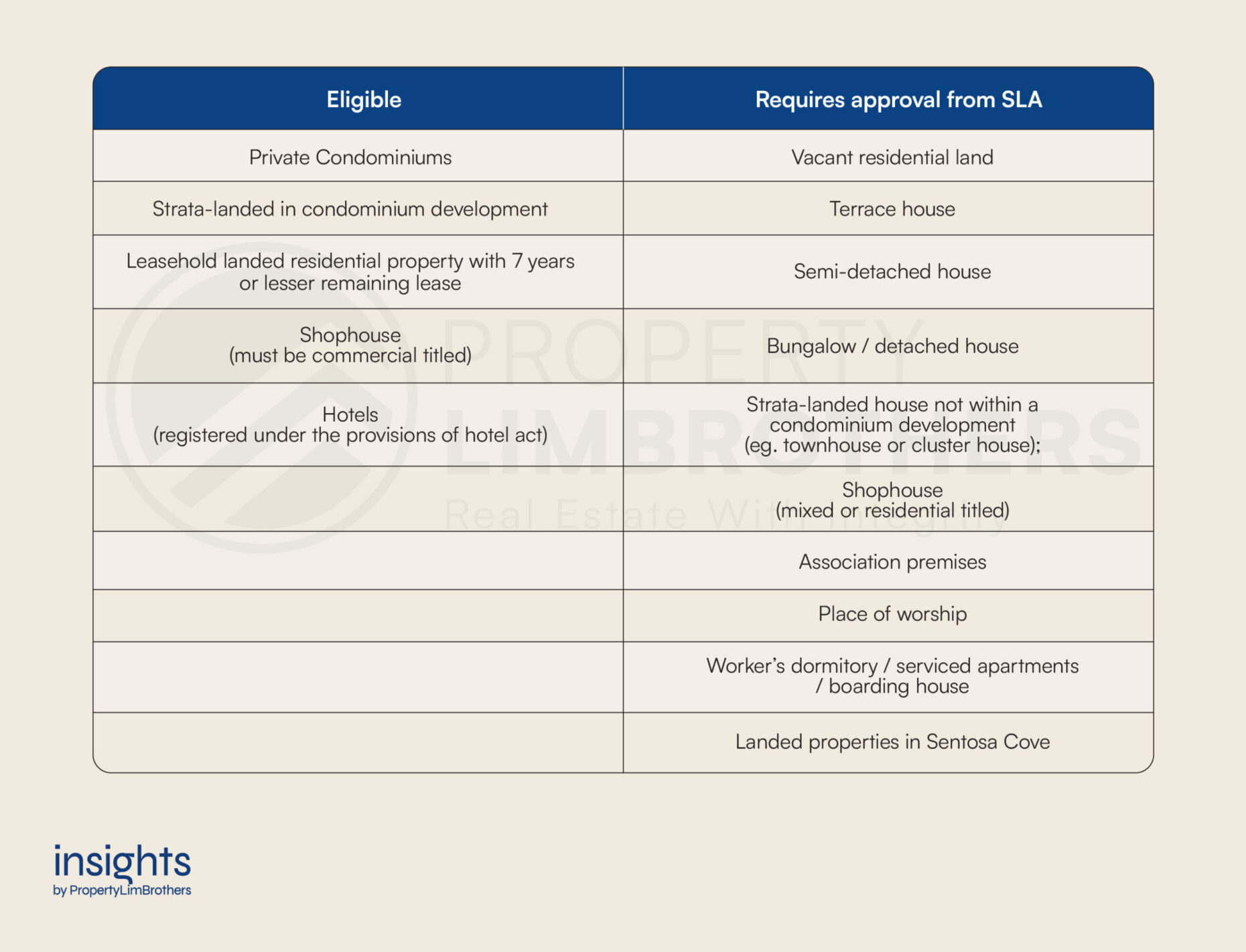

Foreigners looking to purchase private housing in Singapore are subject to less stringent restrictions regardless of their residency statuses. For private residential properties such as condominiums and apartments, there are no restrictions on the location and foreigners are not subjected to MOP before renting out or selling their properties.

However, foreigners who wish to purchase landed properties must first obtain approval from the Land Dealings Approval Unit (LDAU) of the Singapore Land Authority (SLA). Alternatively, they may take up a leasehold estate in a landed residential property for up to seven years, including any further renewal terms.

Applicants are assessed on a case-by-case basis, taking into consideration factors such as their permanent residency status of at least five years and their exceptional economic contributions to Singapore, such as their employment income assessable for tax in Singapore.

Foreign buyers are also restricted to residential properties that do not exceed 15,000 sqft and are not situated within a good class bungalow area. Those who wish to apply for such properties will be subject to much more stringent qualifying criteria.

In contrast, the criteria for the purchase of properties in Sentosa Cove still require the LDAU approval but are less stringent. Foreign buyers are only required to use the property solely for their own occupation and that of their family members as a dwelling house, and not for rental or any other purpose. The only restriction is that the property must not exceed 1,800 sqm in size.

Aside from residential properties, foreigners can also invest in non-residential properties such as commercial and industrial properties. Look out for our upcoming article which will cover the pros and cons of investing in those types of properties for foreigners.

Step 2: Understanding the Costs Involved

When considering purchasing property in Singapore as a foreigner, it is important to be aware of the various costs involved. While these costs and regulations may seem burdensome, they are designed to protect the integrity of Singapore’s property market and ensure that it remains accessible to locals. By taking the time to understand these expenses and regulations, foreign buyers can make informed decisions and help contribute to a healthy property market.

Buyer’s Stamp Duty (BSD)

In Singapore, all property purchases are subject to a tax known as buyer’s stamp duty (BSD). As the name suggests, this tax is levied only on the buyers of the property.

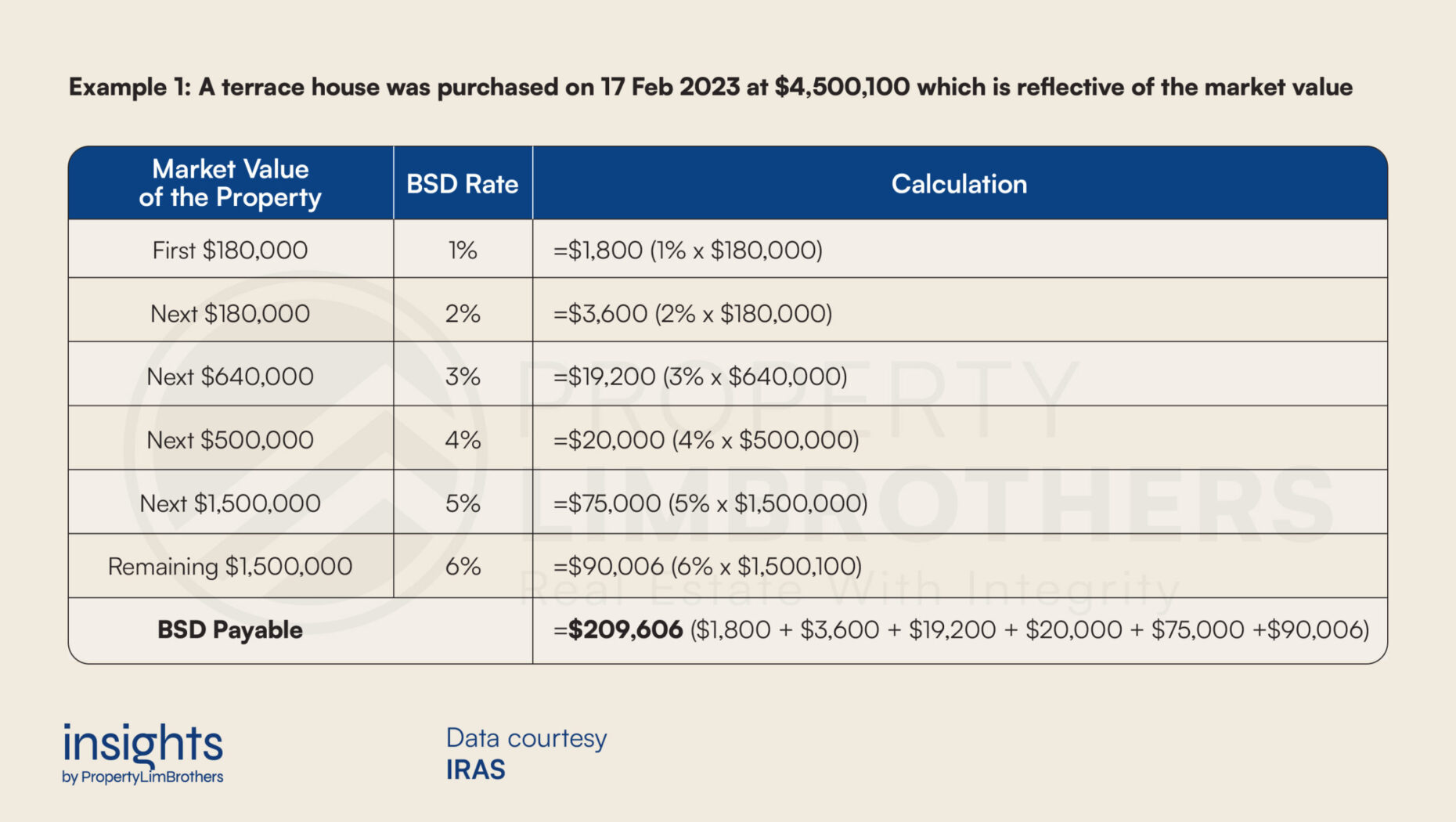

Once the purchase agreement is signed, buyers have 14 days to pay the BSD. The amount of BSD payable is calculated based on either the purchase price stated in the agreement or the property’s market value as determined by a valuation report, whichever is higher.

This means that even if the purchase price negotiated is lower than the property’s valuation, the BSD rate will still be based on the higher of the two amounts. Therefore, foreign buyers should be prepared to factor in the cost of BSD when budgeting for their property purchase.

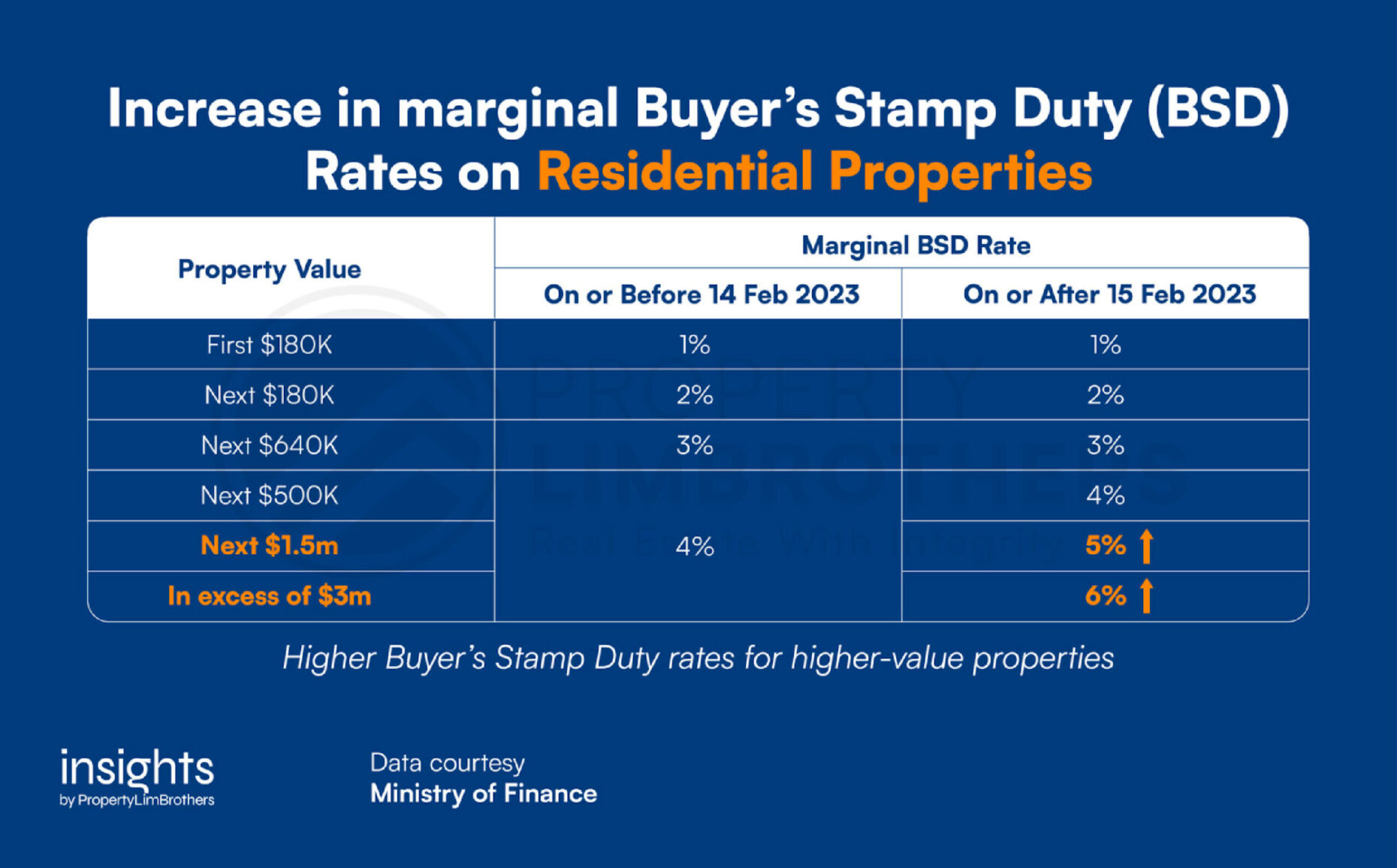

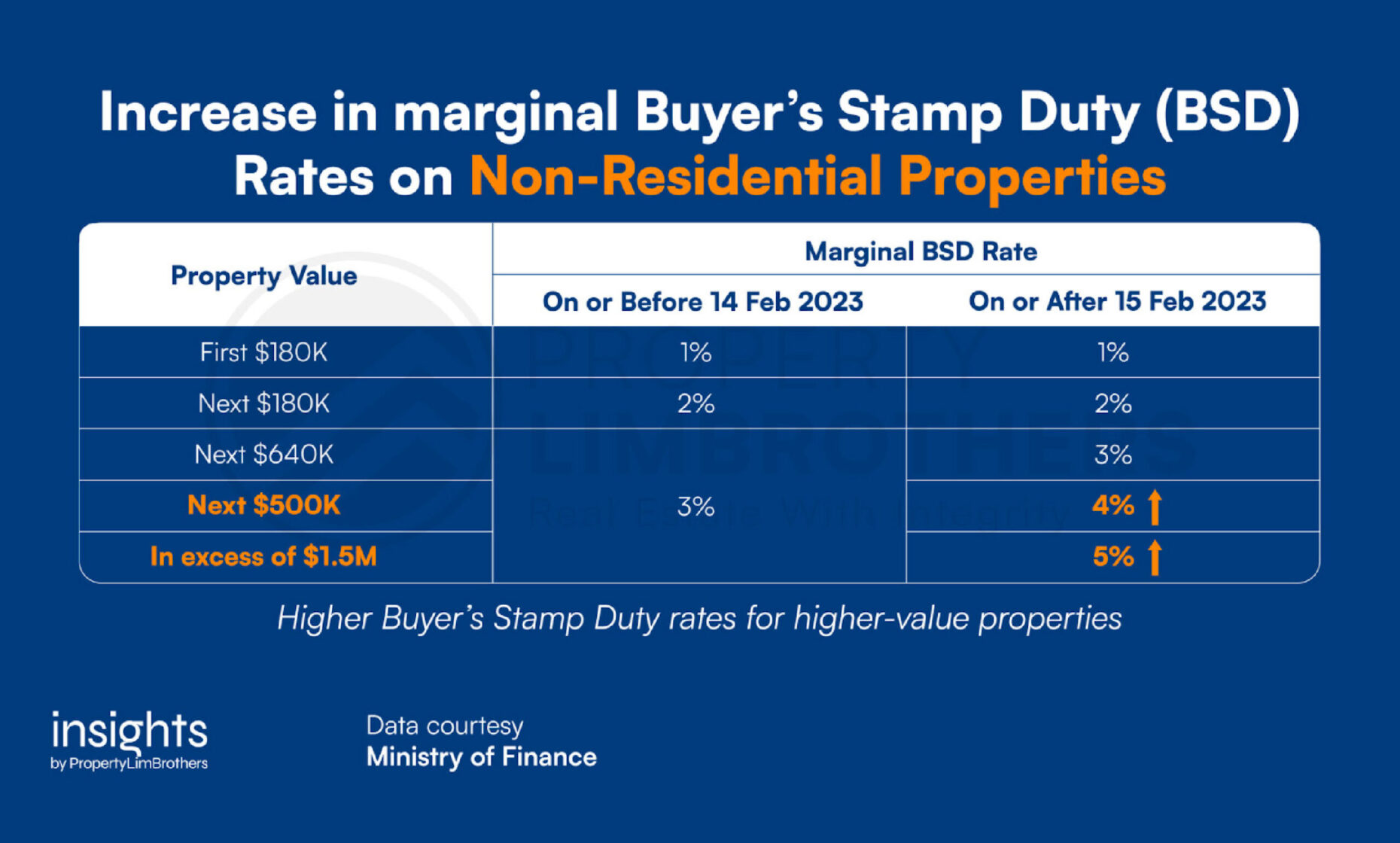

Below are the breakdown of the current BSD rates for residential and non-residential properties (regardless of residency status) after the recent housing policy changes announced in Budget 2023.

Do note that the BSD is a progressive tax rather than a flat tax. This means that the rates will apply to the market value bracket of the property acquired and tabulated up to the full purchase or valuation price. Below is an example to illustrate the tabulation of BSD:

Additional Buyer’s Stamp Duty (ABSD)

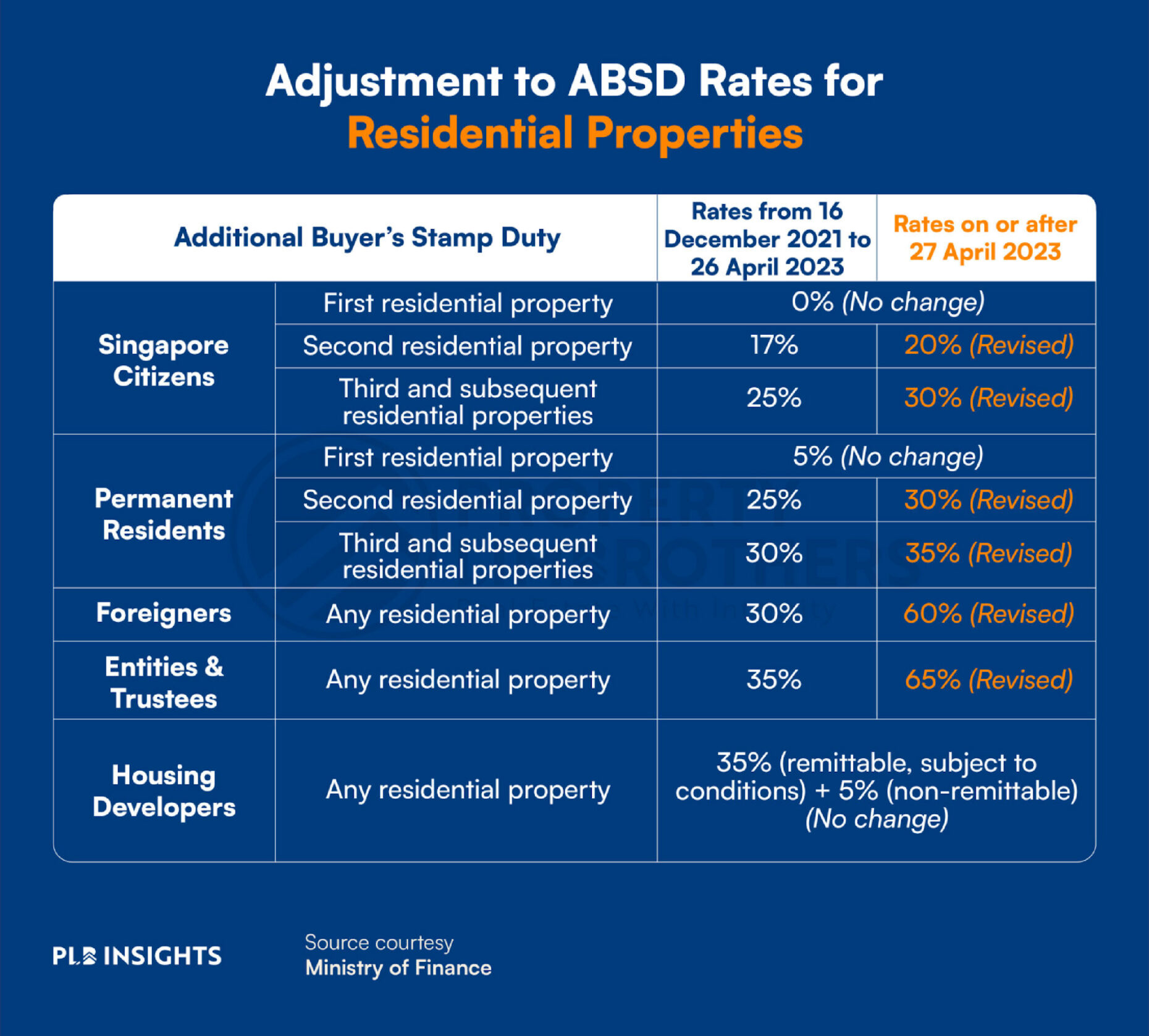

Foreigners who are considering buying real estate in Singapore should take note of the ABSD rates in addition to the BSD. The ABSD was introduced by the Singaporean government in 2011 as an additional cooling measure to manage the rising demand in Singapore’s property market.

ABSD only applies to residential properties, and the rates vary depending on the residency status of the buyer. The latest ABSD rates were released in December 2021, and as of April 2023, the rates are as follows:

- SPRs are required to pay 5% ABSD on their first property, 30% on their second property, and 35% on their third and subsequent properties.

- Foreigners (Non-SPRs) are required to pay 60% ABSD on all the properties they acquire.

A concise table comparing the ABSD rates for different residency statuses is available below. It is important for foreign buyers to be aware of these rates as they can significantly impact the cost of purchasing a property in Singapore.

Under the Free Trade Agreement (FTA), Nationals or PRs of these countries are exempted from foreigner ABSD rates and will be accorded the same Stamp Duty treatment as SCs:

- Nationals and PRs of Iceland, Liechtenstein, Norway, and Switzerland

- Nationals of the United States of America

Or for those that prefer abbreviating these Nationalities, just remember, SNAIL.

Loan-to-Value (LTV) & Total Debt Servicing Ratio (TDSR) for property loans

Foreign buyers have the option to approach any bank for a property loan, if necessary. However, the maximum amount that can be borrowed is subject to the number of existing housing loans the individual currently holds. To get a better idea of the amount that you can loan, apply for an In-Principle Approval (IPA) with your bank. The IPA is typically valid for two weeks.

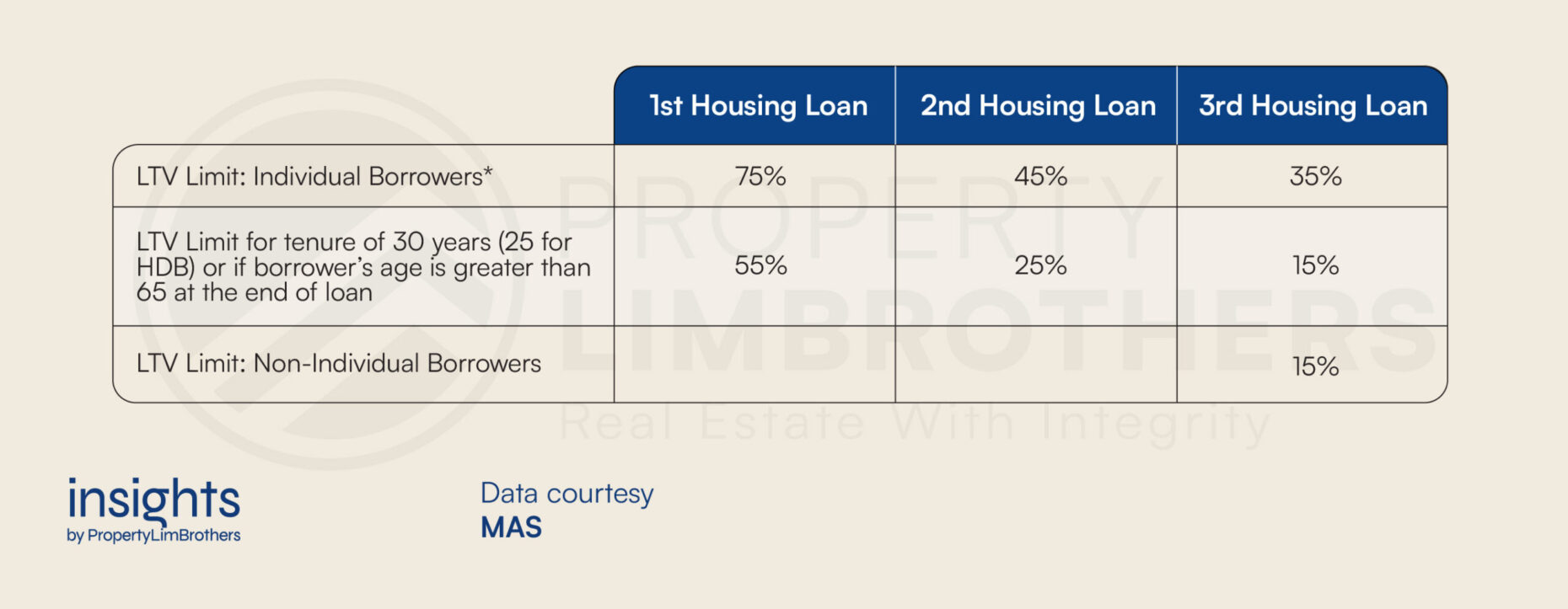

One important policy to take note of is the Loan-to-Value (LTV) limit. It is a regulation that limits the amount of money that banks can lend to buyers when they purchase a property and sets a maximum loan amount that is based on the value of the property being purchased. The policy applies to both local and foreign buyers, but the restrictions are stricter for foreign buyers.

For example, at the time of writing, foreign buyers can borrow up to 75% of the residential property’s value if they are obtaining their first property loan in Singapore. For subsequent loans, the LTV limit is even lower.

Other factors that will influence the loan amount include age, employment status, residency status, and credit score.

The Total Debt Servicing Ratio (TDSR) is another crucial policy to consider when securing a property loan. It refers to the maximum percentage of a borrower’s gross monthly income that can go towards repaying their total monthly debt obligations. This applies to loans offered by financial institutions, for all types of properties and covers properties in and outside Singapore.

At the time of writing, when a buyer applies for a loan, their TDSR is capped at a maximum of 55% of their monthly income. This implies that the sum of all their monthly debt obligations, including housing loans, credit card debts, student loans, car loans, renovation loans, and other secured or unsecured loans, should not exceed 55% of their total monthly income.

Other fees and costs

Some additional fees to take into consideration are the conveyancing fees and legal expenses involved in the property acquisition process.

Conveyancing fees in Singapore typically range from $250 to $6,000 per legal service, depending on the complexity of the transaction. It is highly recommended to engage the services of a qualified real estate lawyer to handle the legal aspects of the purchase.

Step 3: Engage a Property Agent and Lawyer

After understanding the various restrictions and costs involved, it is time to engage a property agent, though you could also engage a property agent to explain everything to you before embarking on your property journey here.

In Singapore, engaging a property agent when buying or selling a property is common practice. With a highly competitive and fast-moving property market, having a trusted and experienced agent can be especially beneficial.

All property agents in Singapore are licensed by the Council for Estate Agencies (CEA), which ensures they adhere to professional standards and ethical conduct. Agents can provide valuable guidance on the latest property trends, pricing, and financing options. They can also help navigate complex legal and regulatory requirements. Furthermore, many property agents in Singapore have established relationships with developers and property owners, which can offer access to exclusive listings and information on any developer discounts.

If you have not already shortlisted some properties that you like, an agent can help you source and shortlist some selections based on your needs and preferences. In the event that you are interested in a new launch property, an agent can also bring you around and serve you at project showflats. When you have made a decision to go through with a purchase, the agent can then assist you with the necessary paperwork and processes.

The commission fees for hiring a property agent are typically around 2% of your property’s valuation, but buyers usually do not have to pay commissions as the sale commission is typically shared between the buying agent and seller’s agent. In the event that you are paying a commission fee, ensure that an invoice from a licensed real estate agency is issued. When paying, do not pass any cash directly to the agent – instead, issue a cheque payable to the realtor’s agency according to the invoice.

It is also important to hire a qualified local lawyer to assist with the contracts and conveyancing of the property during the transaction. They are also responsible for carrying out due diligence checks on the seller (for resale properties) and liaising with the developer’s solicitor (for new launch properties) to ensure that everything is in order.

Step 4: Make an Offer (for Resale properties)

Once you have found a property that suits your needs and preferences, it is time to make an offer to the seller. You can convey your offer to your property agent who will then make the official offer to the seller or seller’s agent. In most cases, other than the offer price, details such as the Option and Completion periods are negotiated. Option periods are generally 14 days and Completion periods are between 10 to 12 weeks. Depending on the seller’s requirements, this is also when an extension of stay after the sale completion may be negotiated.

If the seller finds the offer favourable and decides to close the deal, you may proceed to the next step.

Step 5: The Option to Purchase (OTP) or Sale and Purchase (S&P) Agreement

After the seller accepts your offer, you will have to procure a contractual document called the Option to Purchase (OTP) if you are buying a resale property or enter into a Sale and Purchase (S&P) Agreement with the developer if you are buying a new launch property.

At this stage, you should have already obtained your bank’s IPA if you are taking a property loan. An IPA is essentially the bank’s pledge that they will extend the loan to you for your property purchase, provided that there are no changes to employment status, income, etc. It is important to have an IPA before procuring the OTP. Without an IPA, you risk not being able to secure the full amount you need from the bank, leading to a failure to meet payment schedules for your property and potentially losing your option fee.

In Singapore’s real estate market, it’s common for buyers to provide an option fee to “reserve” the property for an agreed period of time while they consider their potential purchase. The option fee is an essential component of many real estate transactions in Singapore as it helps to ensure that both parties are committed to the sale and have a stake in the transaction’s outcome. This fee is typically held in an escrow account and can range from a few thousand dollars to a percentage of the purchase price, depending on the type of property and the agreement between you and the seller. For private properties, the option fee is typically 1% of the purchase price.

By providing the option fee, the buyer shows their serious interest in purchasing the property and secures it for a specified period, during which they can conduct due diligence and evaluate their ability and willingness to proceed with the purchase.

If you decide not to proceed with the purchase within the agreed time frame, for reasons such as being unable to secure financing or changing your mind, you risk forfeiting the option fee. However, if the sale goes through, the option fee is typically applied towards the purchase price.

In the event that you require more time to decide whether to exercise the option or not, you may request an extension from the seller through your agent. However, it is important to note that the seller is not obligated to grant an extension and may choose to decline the request.

It is crucial to exercise the option within the specified time frame. Failure to do so will result in the forfeiture of the option fee and the opportunity to purchase the property. Therefore, it is recommended to carefully consider all relevant factors before entering into the option agreement and seek legal advice if necessary.

To proceed with the transaction, exercise the option by signing the OTP. If you are overseas at this point, you could sign the OTP before a Notary Public or officer at the Singapore Consulate, and send the duly signed and witnessed OTP back to your lawyer in Singapore by courier.

Step 6: Exercise Option and Complete the Sale

Once you have decided to proceed with the transaction, exercise the option by signing the agreement at your lawyer’s office. Following this, you will need to submit the agreement along with a payment of 4% of the purchase price, or the amount agreed upon between you and the seller, to the seller’s lawyer.

Once the agreement between you and the seller is reached, it is time to hand over the reins to your lawyer for the completion of the sale. The process typically takes around 10 to 12 weeks, during which your lawyer will take care of all the necessary paperwork for the conveyancing of the property.

Your lawyer will also be responsible for lodging a caveat on the property, coordinating with the financial institution and CPF board (if applicable), and preparing the mortgagor/mortgagee documents. They will also ensure that you pay the stamp duty fees to the Inland Revenue Authority of Singapore (IRAS) within 14 days of exercising the OTP or signing the Sales and Purchase Agreement if you’re buying from a property developer.

After all the necessary paperworks and payments are settled, you can look forward to taking possession of the property and moving into your new abode!

Closing Thoughts

Buying a property in Singapore as a foreigner requires careful planning and preparation. There are several legal and financial requirements that you need to comply with, and navigating the complex Singapore property market can be a challenge. However, by following the step-by-step guide outlined in this article, you can make informed decisions and ensure a smooth transaction process.

One of the most important steps in buying a property in Singapore as a foreigner is conducting thorough research. This includes understanding the different types of properties available, such as condominiums, landed properties, and HDB flats, and their associated costs and restrictions. It also involves familiarising yourself with the various neighbourhoods and their amenities, as well as staying up-to-date on the latest property trends and market conditions.

Another crucial aspect of buying a property in Singapore as a foreigner is seeking professional advice. This includes engaging a trustworthy property agent, as well as consulting with a lawyer, tax advisor, and mortgage broker to ensure that you are fully aware of all legal and financial requirements.

When it comes to financing your property purchase, it is important to keep in mind that as a foreigner, you may be subject to stricter lending requirements and higher interest and ABSD rates. However, there are several financing options available, including bank loans and private financing, and it’s important to carefully consider your options and choose the one that best fits your needs and budget.

We hope that this article has given you a clearer understanding of the entire process of purchasing a property in Singapore as a foreign buyer. If you are looking to enter the Singapore real estate market, or have further questions about the process, do get in touch with our PropertyLimBrothers team. Our experienced and dedicated team can guide you through the whole process, provide you with the latest market analyses and trends, and advise you on whether your move will be prudent and where the opportunities lie.

PropertyLimBrothers, always happy to show you the place.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.