With the revision of Additional Buyer’s Stamp Duty (ABSD) in April 2023—20% ABSD for Singaporeans purchasing a second residential property and a hefty 60% for foreigners—the calculus for real estate investment in Singapore has fundamentally changed. Investors, both local and international, are now re-evaluating their portfolios and looking beyond the increasingly regulated residential sector.

Commercial and Industrial real estate has surfaced as a compelling alternative. Unencumbered by ABSD, accessible to foreigners, and offering competitive yields, commercial properties are increasingly recognised not just as business assets, but as vehicles for capital preservation and growth.

This article serves as a primer, introducing key concepts and considerations that form the bedrock of commercial real estate investment in Singapore.

Commercial Property: A Strategic Gateway

Commercial real estate is a broad class comprising:

- Retail spaces: Shop units in malls, street-front retail, F&B outlets.

- Office properties: From strata offices in suburban hubs to Grade A buildings in the CBD.

- Shophouses: Conservation heritage assets offering both rental and capital appreciation upside.

Understanding the distinctions and market dynamics of each type is crucial for effective investment.

Dissecting the Asset Classes

Retail Spaces

Retail properties cater primarily to consumer-facing businesses. Demand is heavily footfall-driven and location-sensitive. Prime retail spots (e.g. Orchard Road, Jewel Changi) command premium rents, while suburban malls benefit from residential catchments. However, retail is cyclical and exposed to e-commerce disruption. Lease structures are usually short (1–3 years), but rental reversion potential remains strong if tenant mix is well-curated.

Office Spaces

Singapore’s office market is segmented by grade (A, B, and C), with Grade A spaces in the CBD (e.g. Marina Bay Financial Centre) appealing to MNCs and financial institutions. These properties enjoy stable long-term leases (3–5 years) with higher tenant stickiness.

In contrast, strata-titled suburban offices (such as those located in Ubi or Woodlands) offer more affordable entry points and decentralisation opportunities aligned with URA’s long-term urban planning.

Shophouses

Shophouses—particularly those in conservation areas such as Tanjong Pagar, Chinatown, and Joo Chiat—have grown in popularity due to their limited supply and architectural heritage. These properties often blend residential and commercial use and are highly customisable.

They are not subject to ABSD or foreign ownership restrictions (if zoned commercial) and offer strong capital upside.

Strata-Titled vs. Whole-Ownership Assets

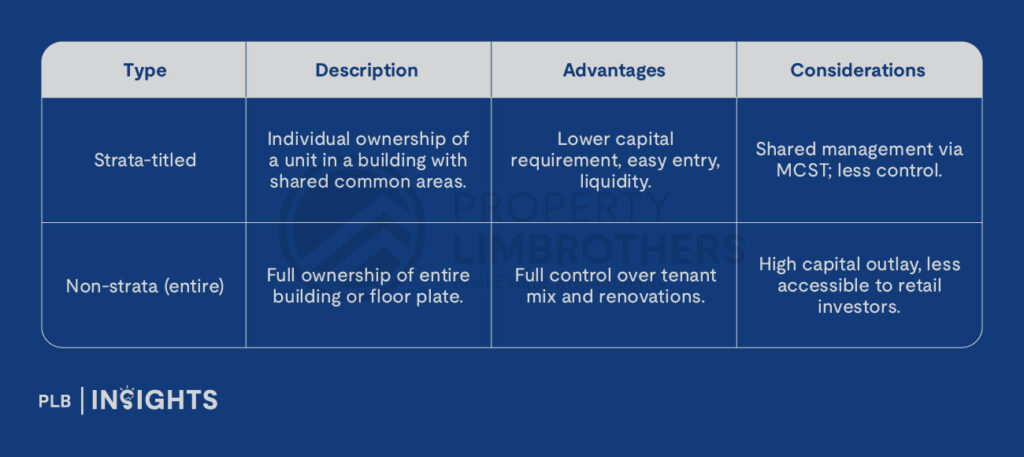

A key structural differentiation in commercial property investment is ownership format:

Understanding this distinction is key for long-term strategy, especially for those looking to implement value-add strategies or repositioning plays.

Ownership Landscape: Institutional vs. Private Investors

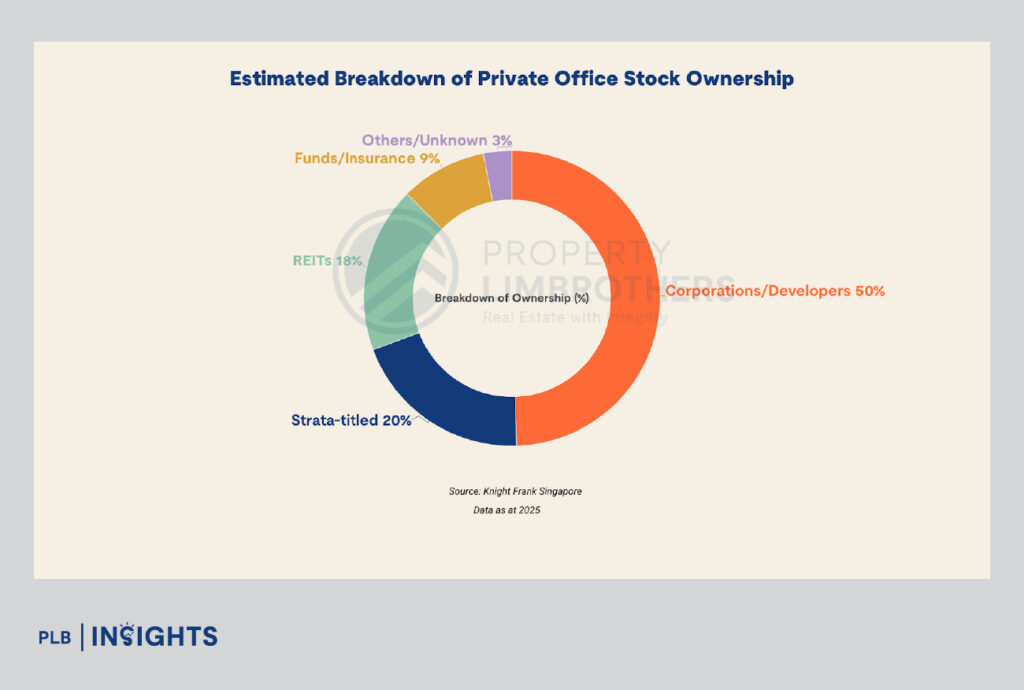

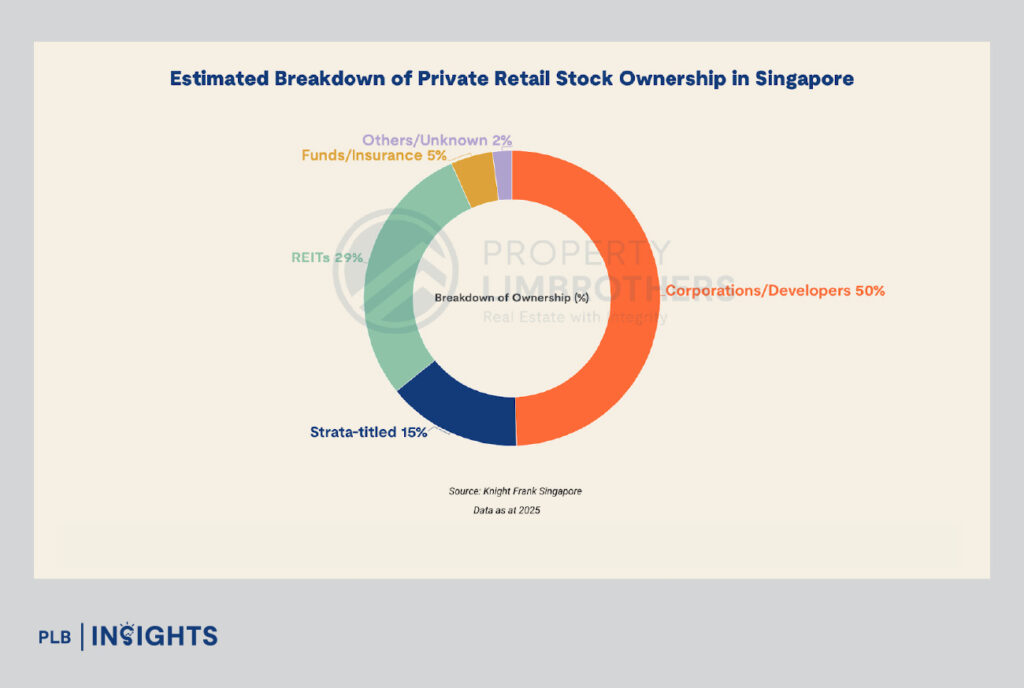

A breakdown of Singapore’s commercial property market reveals a dominant presence of institutional players such as Real Estate Investment Trusts (REITs), which hold premium CBD assets. REITs offer fractional ownership with liquidity via SGX trading but are subject to broader market volatility and management fees.

Conversely, private investors dominate the strata-titled office and shophouse segments. These segments are more accessible, require active asset management, and often offer superior yields when tactically executed.

Advantages of Commercial Property Investment

No ABSD

Perhaps the most powerful advantage in today’s regulatory climate, commercial properties are exempt from ABSD—making them more cost-effective for second-property buyers and foreign investors alike.

Foreigners can Invest with Minimal Restrictions

Unlike landed residential properties, most commercial assets are fully open to foreign ownership with minimal restrictions.

Higher Rental Yields

Typical gross yields range from: Retail: ~3%; Office: ~5%; Shophouses: 2%-3%, with potential capital upside

This compares favorably to 2%–3% average yields for private residential properties.

Lower Property Taxes

Commercial property tax rates are lower and not progressive, unlike residential tax brackets that penalise high-value homes and non-owner-occupied units.

Strategic Use for Business Owners

Owner-occupiers can leverage commercial units for business operations while capturing potential appreciation. For SMEs, this can function both as a cost-control measure and long-term investment.

Risks and Considerations

No asset class is without risk. Here are key downsides to watch:

Proper risk mitigation through tenant diversification, location strategy, and macroeconomic monitoring is essential.

Strategic Considerations for 2025 and Beyond

Macro Tailwinds:

Singapore’s stable governance, AAA credit rating, and continued push to attract global talent (via ONE Pass and business-friendly policies) support long-term demand for commercial spaces.

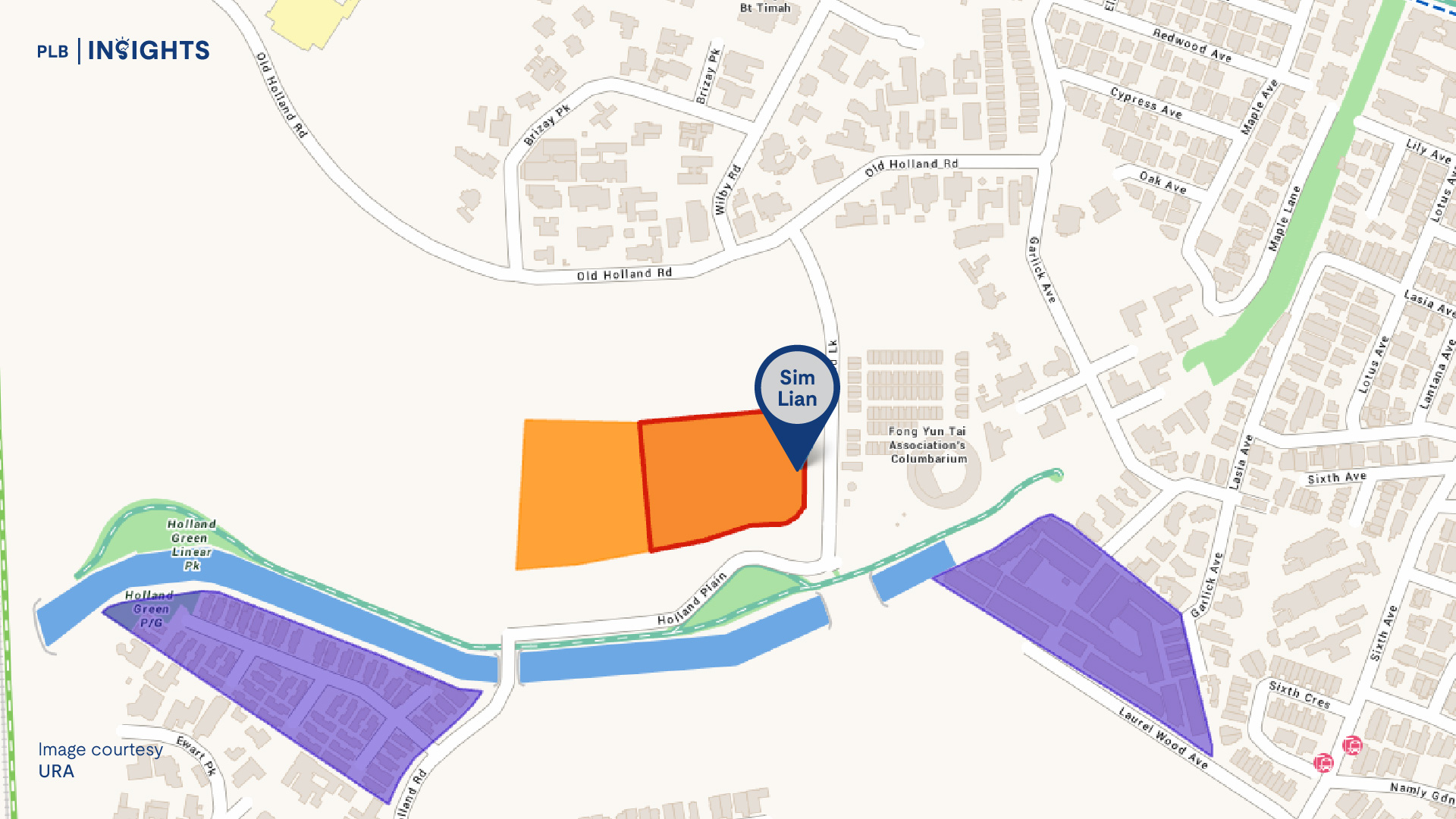

Infrastructure initiatives such as the Greater Southern Waterfront and Paya Lebar Airbase transformation promise uplift for fringe commercial districts.

Micro Trends:

Hybrid work models may impact CBD office demand, pushing interest toward decentralised Grade B spaces.

Sustainability certifications (e.g., Green Mark Platinum) are increasingly important for tenant demand and asset valuation.

Conclusion: A Gateway to Diversification and Long-Term Growth

As regulatory pressure intensifies on residential investments, commercial real estate emerges as a pragmatic and promising avenue. While not without complexities, the combination of ABSD exemption, broader accessibility, and income potential makes it a valuable tool for wealth preservation and growth.

For investors looking to diversify and defend against policy shocks, commercial property may be not just an alternative—but the smarter move.

Stay Updated and Let’s Get In Touch

Questions? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.