Strata cluster homes are a unique type of housing in Singapore that combines the features of landed properties with the shared facilities typically found in condominiums. These homes are designed to offer a landed living experience within a gated community while providing amenities similar to those in condos, such as swimming pools, gyms, and playgrounds.

As we have already covered the characteristics of strata cluster homes in our previous article, this article will focus on examining the performance of cluster homes as a property investment, with an emphasis on both capital appreciation and rental yields.

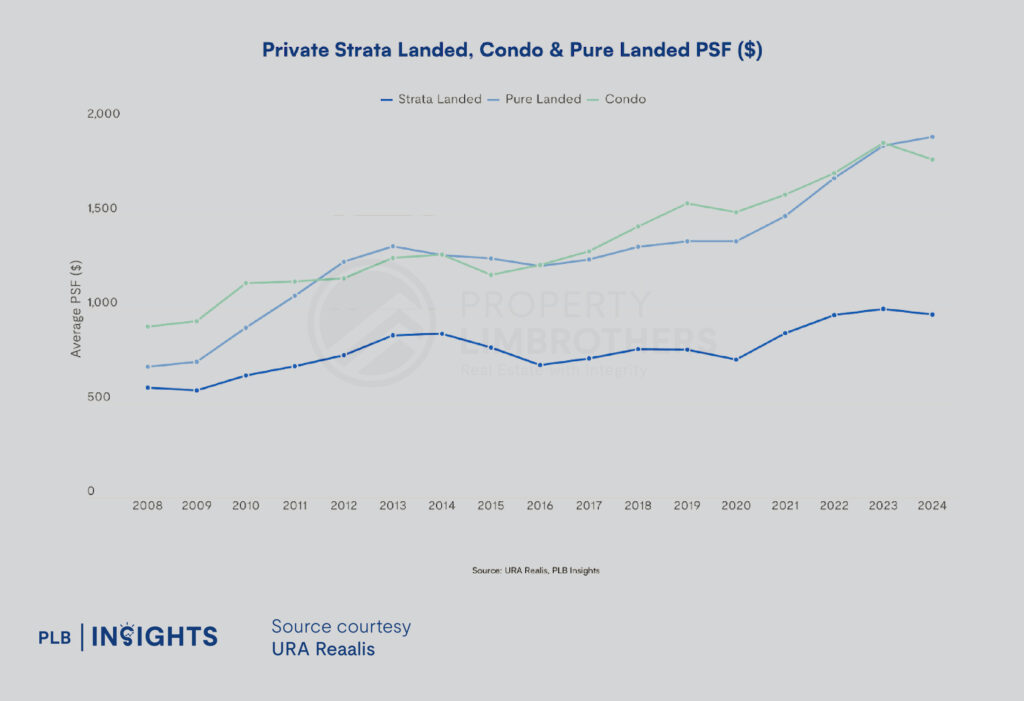

Comparison of Strata Landed, Condo, & Pure Landed

In Figure 1 above, we compare the price trends (average PSF price provided by URA) among strata landed, condo, and pure landed over the years from 2008 to 2024. In the chart above, cluster houses are referred to as Strata Landed.

Condo and pure landed average PSF price tracks almost closely to one another on an upward trend, except that the average PSF price for condo seems to have dipped this year. In contrast, the average PSF price for strata landed properties has remained relatively flat over the past three years.

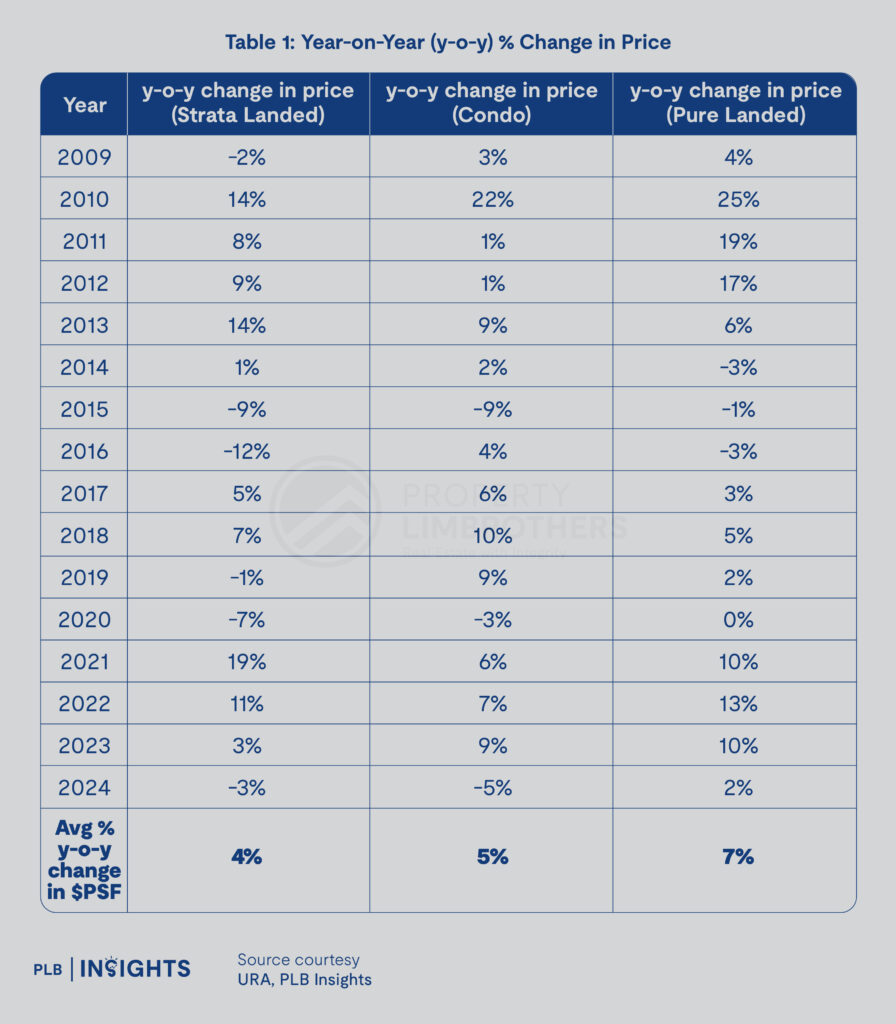

We also compared the year-on-year (y-o-y) % change in price for these three types of properties. The average y-o-y percentage change in PSF price for cluster homes, condo and pure landed homes are 4%, 5% and 7%, respectively.

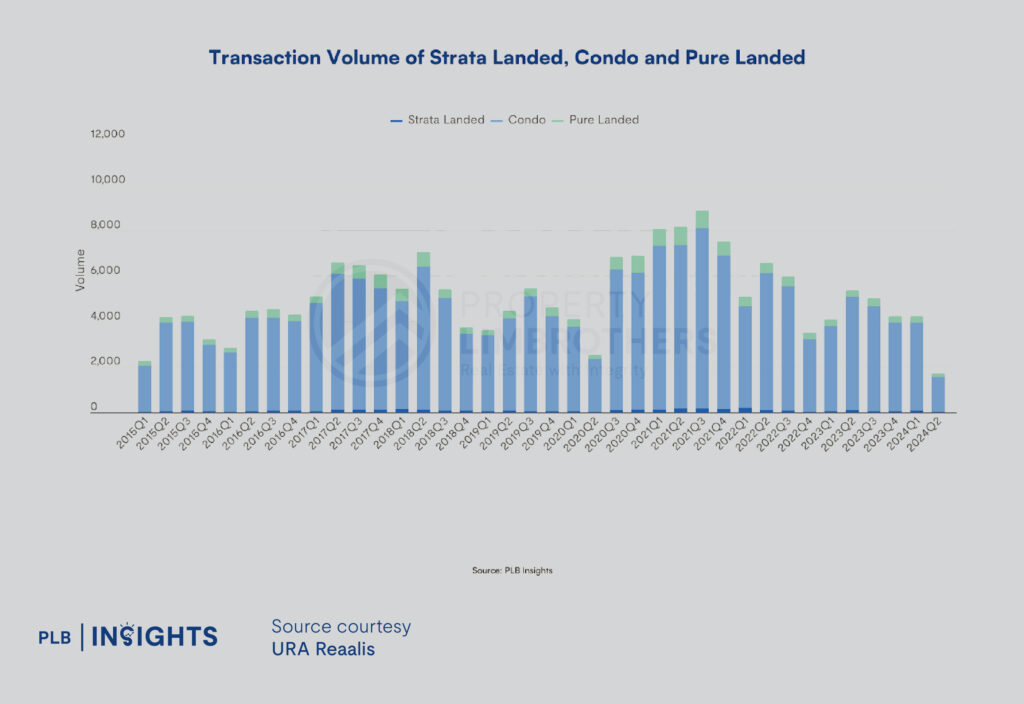

The relatively flat and smaller price movements for strata landed properties could be attributed to their lower transaction volume compared to condos and pure landed properties, as shown in Figure 2 above. The low volume transaction of cluster homes over the last two years could have hindered price appreciation to some extent.

However, it’s important to note that cluster homes in Singapore are rare and have a limited supply, which naturally results in lower transaction volumes compared to condos and pure landed properties.

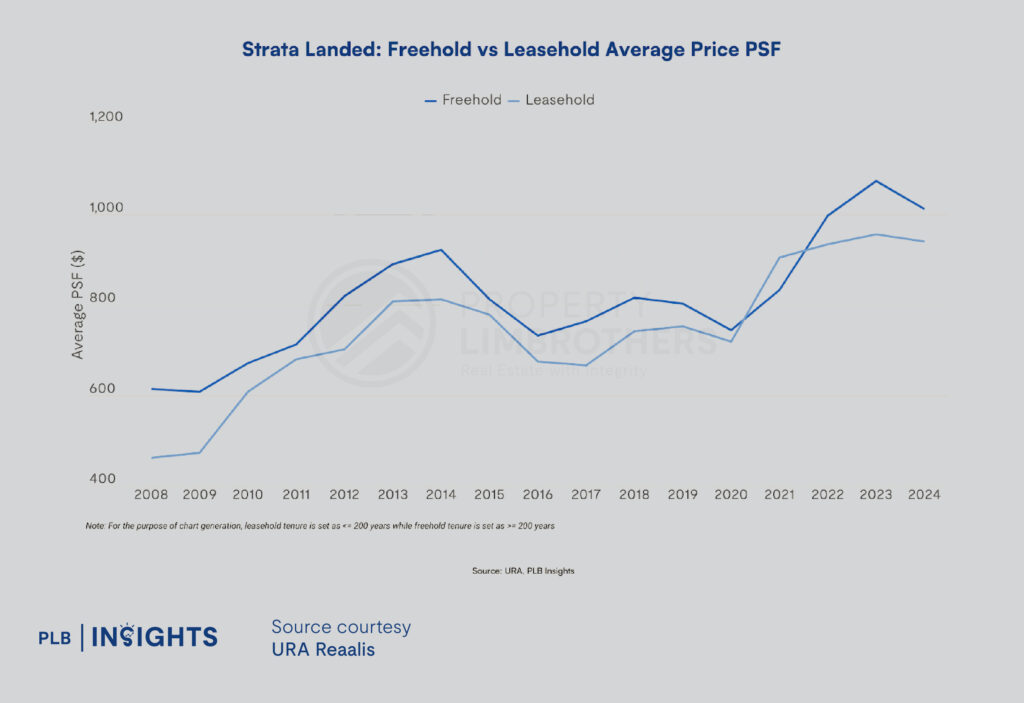

When comparing the price trends of freehold versus leasehold strata landed properties, we observe that both follow a similar price trajectory, with leasehold properties generally having a lower average PSF price than freehold ones. The only exception was in 2020 to 2021, when leasehold properties briefly outpriced freehold ones. Interestingly, in 2024, the price gap between freehold and leasehold properties appears to have also narrowed.

Comparing the y-o-y change in price for freehold and leasehold gives an average y-o-y percentage growth of 3.6% and 5.1%, respectively, since 2008. It is even interesting to see that the average price growth for leasehold cluster homes outweighs that of freehold ones.

Undoubtedly, when we examine the prices of cluster homes, whether freehold or leasehold, the average PSF price is generally on an upward trajectory. However, the higher price growth may be due to the lower average PSF price in the earlier years (2008 to 2010) before the for leasehold price increased steeply to match with the market, as seen in 2010 when leasehold average PSF price grew by 28.5%.

The prices of cluster homes tend to fluctuate along the way, with occasional periods of negative growth rates, which has made them unpredictable.

Rental Yield Analysis

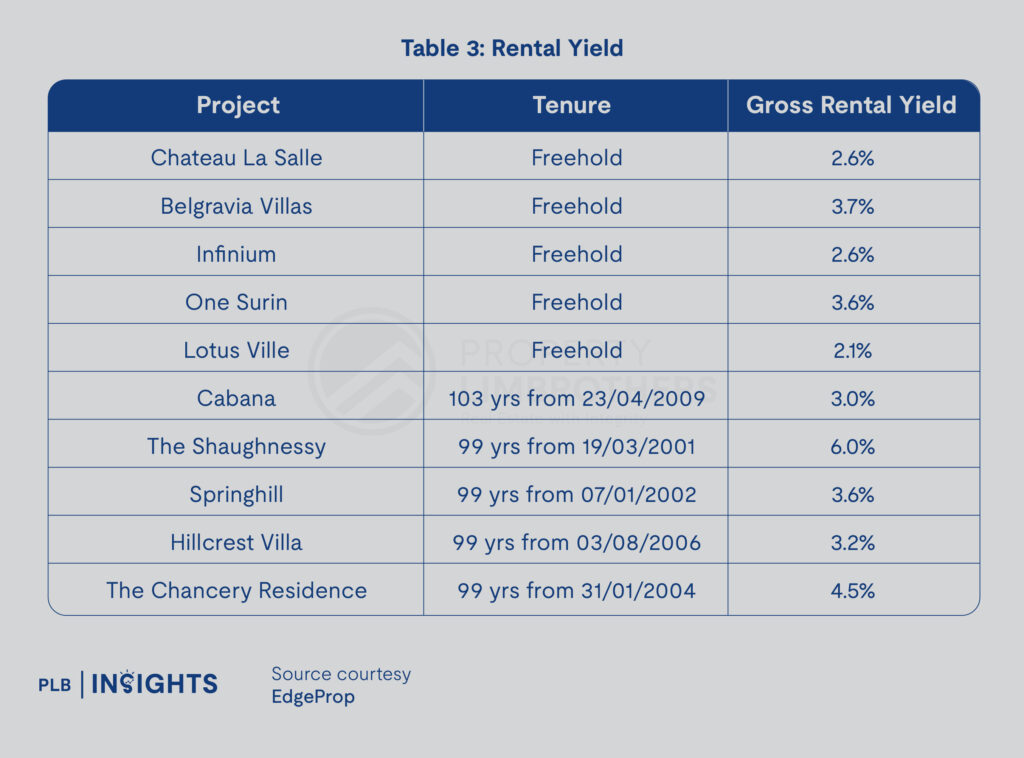

Next up, we look at the rental yield of Cluster homes. To keep things simple, we will review 10 cluster homes and examine the rental yield.

Based on data from EdgeProp, the gross rental yields for cluster homes are competitive, ranging from approximately 2% to 4%, with some properties, like The Shaughnessy, exceeding 5% and reaching as high as 6%, as seen from Table 3.

Despite the general lower prices of cluster homes compared to landed properties (as seen in Figure 1), the gross rental yields of cluster homes are on par to those of landed properties, according to EdgeProp. This indicates that cluster homes are capable of fetching strong rental returns, making them a potentially attractive investment option.

Final Thoughts

Similar to other property types, the price of cluster homes have been on an upward trend. However, cluster homes have experienced price fluctuations over the past few years, despite demonstrating strong rental yields. Due to their lower transaction volume compared to condos and pure landed properties, cluster home prices tend to be more volatile and less predictable as compared to condos and pure landed properties.

With their unique combination of landed living and shared facilities, cluster homes offer a distinctive appeal, particularly to homeowners who desire the experience of living in a landed property but prefer having common facilities managed by a third party. They are also priced lower than pure landed homes, making them a relatively more affordable option in terms of owning a landed property in Singapore.

Their rarity and specialised market position make cluster homes a niche choice for a specific segment of buyers, making them more appealing for residential use rather than as an investment option.

We understand that navigating the property market can be challenging, especially with its fluctuating cycles. That’s why we’re here to equip you with the latest information to help you make well-informed decisions. Whether you’re a first-time homebuyer, a seasoned investor, or simply exploring your options, our team of knowledgeable consultants is here to guide and support you every step of the way.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.