The Singapore government’s Budget 2023 has brought good news for first-time home buyers who are looking to purchase a resale HDB flat. As part of the government’s efforts to support home ownership, an additional grant of $30,000 has been introduced for first-time buyers. This grant is expected to provide a significant boost to many Singaporeans who are struggling to afford their first home.

In this article, we will analyse how this additional grant can impact the first home buying journey of the average couple in Singapore. We will examine the affordability of resale HDB flats and explore the potential benefits of this grant for first-time buyers. Join us as we take a closer look at this crucial aspect of the Budget 2023 and its impact on the real estate market in Singapore.

If you have not read our article on the Budget 2023 changes, you can catch it here.

Why Increase the CPF Housing Grant?

The cost of purchasing a home in Singapore has always been a major concern for many Singaporeans, especially for first-time buyers who are looking to get a foot on the property ladder. The government has recognised this and has taken steps to address the issue by introducing various measures to support home ownership.

One such measure is the introduction of an additional grant of $30,000 under the CPF housing grant for first-time buyers in the Budget 2023, bringing the total CPF housing grant to $80,000 for 2-4 room flats. This grant is expected to help many Singaporeans who are struggling to afford their first home, particularly resale HDB flats.

Resale HDB flats are a popular option for first-time buyers as they offer more flexibility in terms of location and floor area. The ability to move-in relatively fast upon purchase is also a crucial factor as couples need not wait for years as they do for a BTO flat. However, the rising cost of HDB flats has made it increasingly difficult for many Singaporeans to afford them. The average psf for 2-4 room resale HDB flats has increased by 7.6% from Q4 2021 to Q4 2022.

The additional grant of $30,000 for first-time buyers is expected to make a significant impact on the affordability of resale HDB flats. The grant will be disbursed on top of the existing grants for first-time buyers for resale HDB, which include the Enhanced CPF Housing Grant (EHG) and the Proximity Housing Grant (PHG). Together with the existing grants, first-time buyers can receive up to 190k in grants to help with the purchase of their first home.

With the additional grant, the average couple in Singapore may be able to afford a resale HDB flat that is priced slightly higher than what they would have been able to afford without it. And even for the same quantum resale HDB flat, the average couple would also have a much better financial position and cash flow thanks to the grant.

In addition to making it easier for first-time buyers to purchase their first home, the additional grant is also expected to have a positive impact on the real estate market in Singapore. The increased demand for resale HDB flats may have the potential to push up prices, which may benefit current HDB flat owners who are looking to sell. We will elaborate more on this point later in the article.

The additional grant of $30,000 for first-time buyers in the Budget 2023 is a much-needed boost for many Singaporeans who are struggling to afford their first home. With the grant, more first-time buyers may be able to enter the property market, which can have a positive impact on the economy and the real estate market in Singapore.

The Positive Impact on the Average Couple’s HDB Journey

The additional grant of $30,000 for first-time buyers in the Budget 2023 can positively impact the first-time home buyers’ journey in several ways. For many first-time buyers, purchasing a home is a significant financial commitment, and the grant can help ease some of the financial burdens. In this section, we will illustrate the benefits of the additional grant for a fresh university graduate couple.

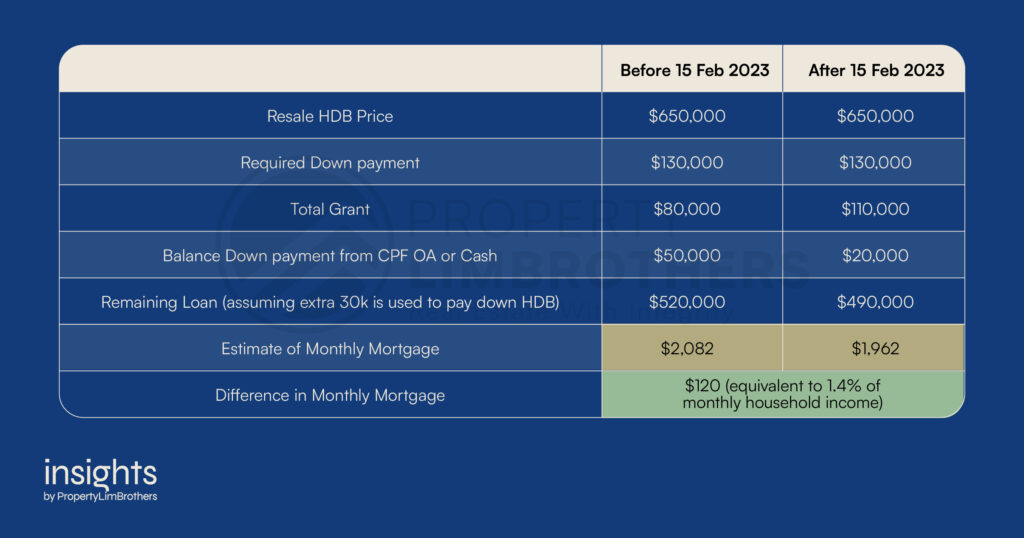

Our assumption is that the household income is $8,400, which is the dual-income family’s median wage according to the data from Straits Times. We assume that the couple buys a decent 4 room resale HDB at the price tag of $650,000, with no COV. We also assume that they are eligible for $20,000 in grants for living within 4km of their parents under the Proximity housing grant. The couple is taking the HDB loan which has a down payment of 20%, and an interest rate of 2.6% with a loan tenure of 30 years.

Firstly, the grant can help buyers increase their down payment, which in turn can lead to a lower monthly mortgage payment. A higher down payment reduces the amount of money that a buyer has to borrow, which can result in a lower monthly mortgage payment. This can help first-time buyers better manage their monthly expenses and free up some money for other essential expenses. This is illustrated in the table below. While this might seem like a small number for a university graduate couple, for families with lower incomes, it could be a huge difference in living expenses and lifestyle.

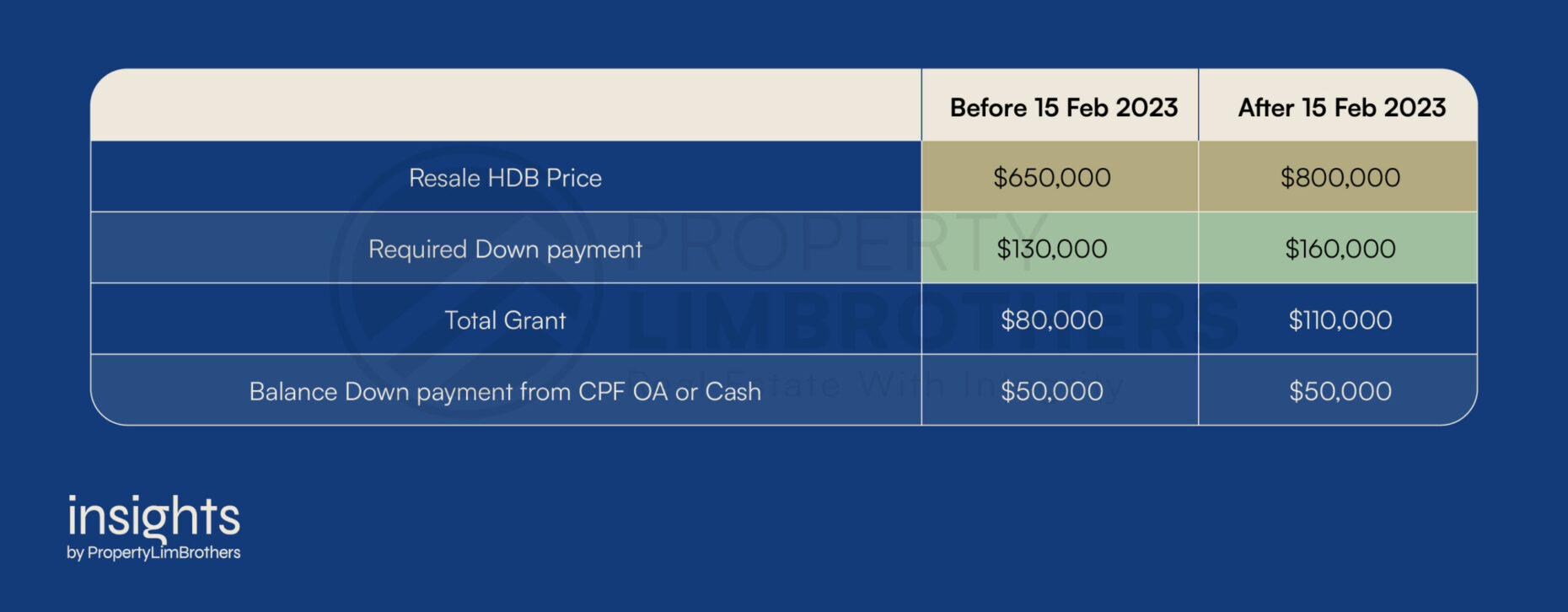

Secondly, the grant can help buyers afford a home that they may not have been able to afford otherwise. With the additional 30k grant, the affordability of resale HDB flats increases, and first-time buyers with lower incomes may now be able to purchase a home that would have been previously out of their reach.

This can significantly impact their quality of life, as owning a home can provide a sense of stability and security. With the same amount of savings of $50,000 in CPF OA and Cash, the couple can now afford a property which has a quantum of $800,000. This is $150,000 higher than before. This could mean a huge lifestyle difference by choosing a more premium location or a newer resale option with a longer balance lease. The assumption here is that the couple is applicable for the higher loan quantum.

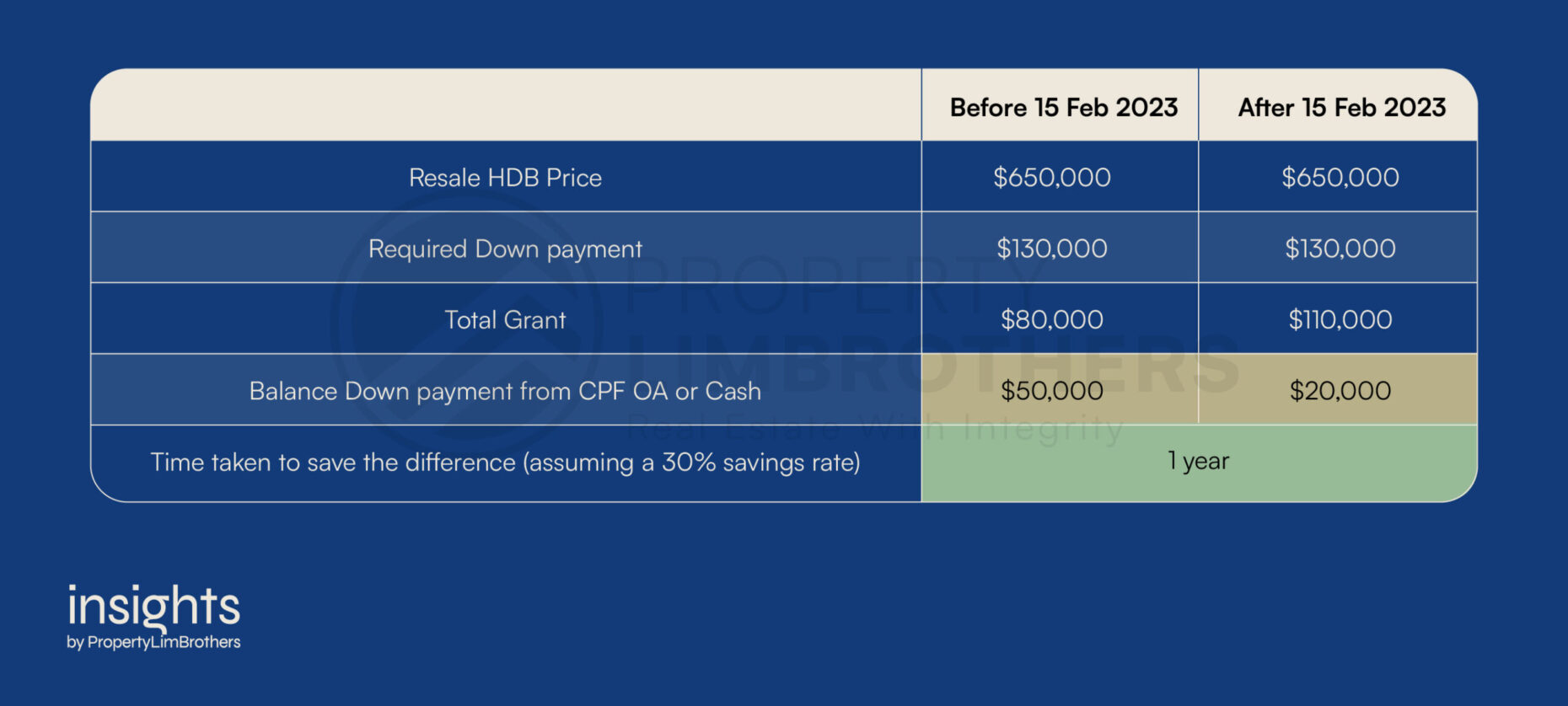

Thirdly, the grant can help first-time buyers save time in their home buying journey. For many lower-income individuals, saving enough money for a down payment can take several years, and in some cases, it may take up to a decade or more. With the additional grant, the amount of time required to save for a down payment is significantly reduced, and buyers can enter the property market much sooner. Looking at the table below, it takes the couple an additional year to save up the difference of $30,000. We all know how long one year can be for a young couple looking to settle down, and this might make a huge difference to some Singaporeans.

Note that for lower income families, the amount of time it takes to save up the difference can take much longer. The $30,000 difference can be a game changer for these families, especially when it reduces the amount of time it takes to save up the difference.

Lastly, the grant can help first-time buyers avoid tapping into their savings for a down payment. Many buyers use their savings to pay for a down payment, which can significantly impact their personal finances. With the additional grant, buyers may be able to avoid dipping into their savings, which can help them maintain their financial security and stability. This additional $30,000 can be an important rainy-day saving for a potential recession, or even enough for a start-up fund for a business idea. This is equivalent to 12 months of savings, which is enough to tide the couple through unemployment for both of them for 6 months.

The additional grant of $30,000 for first-time buyers in the Budget 2023 can positively impact the first-time home buyers’ journey. It can help increase the down payment, reduce monthly mortgage payments, increase affordability, save time, and avoid tapping into personal savings. Overall, the grant is a significant step towards making homeownership more accessible and affordable for many Singaporeans.

Are the Grants adding Fuel to the Inflation Fire?

While the additional grant of $30,000 for first-time buyers in the Budget 2023 can have a positive impact on the personal finances of first-time buyers, there are also some concerns Singaporeans have with this new policy.

One of the main concerns with this policy is that it could contribute to inflation in the housing market. When the government provides additional funds for first-time buyers to purchase homes, it can increase the demand for housing, which can lead to higher prices. This can make housing less affordable in the long run, particularly for those who are not eligible for the grant or cannot afford to buy a home without it.

Another concern with this policy is that it may not address the root causes of housing affordability in Singapore. While the grant can help first-time buyers afford a home, it does not address the underlying issues of limited land supply and high construction costs that contribute to high housing prices in Singapore. As a result, the grant may only provide temporary relief for first-time buyers, and the long-term affordability of housing in Singapore may remain an issue.

Additionally, the grant may have unintended consequences for the broader housing market. For example, if the demand for resale HDB flats increases due to the grant, it may lead to a decrease in the supply of flats available for sale, which can drive up prices for other buyers who are late to the party. This can make it more difficult for buyers who are not eligible for the grant to afford a home down the road.

In other words, while the additional grant of $30,000 for first-time buyers in the Budget 2023 can provide significant benefits for first-time buyers, it is not without its potential drawbacks. The policy could contribute to inflation in the housing market, fail to address some of the underlying issues of housing affordability, and have unintended consequences for the broader housing market.

Ultimately, this is to help aid first time home buyers bridge the affordability gap. To prevent home sellers from further driving prices up and potentially causing another drastic price increase, HDB regulations on valuing the property may see more stringent measures. Which in turn, will curb any potential sudden price increase due to the additional grants. This is similar to that of the GST rise where there was a disclaimer to take action against unjustified increases in prices. However, this still may not stop home sellers from asking for higher prices in anticipation of higher affordability and may potentially create another COV situation where prices do not match valuations.

Housing Policy: A Difficult Balancing Act

When weighing the pros and cons of the additional grant of $30,000 for first-time buyers in the Budget 2023, it is important to consider the potential economic impacts of the policy in greater detail.

One of the key advantages of the grant is that it can help lower-income families enter the housing market. For many families, the upfront costs of purchasing a home, such as the down payment and other closing costs, can be a significant barrier to homeownership. By providing an additional $30,000 grant, the government can help offset some of these costs and make homeownership more accessible to families who may not have been able to afford it otherwise.

This can have significant long-term benefits for low-income families. Homeownership is often seen as a way to build wealth, as property values tend to appreciate over time. By enabling more people to enter the housing market, the grant can help reduce wealth inequality and provide a pathway to financial security for low-income families. Additionally, the grant can help stimulate demand in the housing market, which can have positive knock-on effects for the broader economy. When more people buy homes, it can lead to increased spending on furniture, home improvements, and other related goods and services. This can create jobs and support economic growth.

Overall, we believe that the benefits outweigh the potential drawbacks, but it is important to monitor the impact of the grant on the housing market and ensure that housing remains affordable for all Singaporeans.

Final Thoughts

As we move forward, it will be important to monitor the impact of this policy on the housing market and make adjustments as necessary to ensure that housing remains affordable for all Singaporeans. To help keep you informed about these and other important issues in Singapore’s economy, we invite you to attend our upcoming webinars and read our 2022Q4 report and other editorial pieces.

Our webinars will feature expert speakers and provide valuable insights on the latest real estate trends, policies, and investment strategies. Our 2022Q4 report will provide a detailed analysis of the economic landscape in Singapore and offer a broader perspective on where the real estate industry might be headed in the near future. Finally, our editorial pieces will cover a range of topics on real estate, investment, finance, and lifestyle.

We are committed to providing you with the most accurate and insightful analysis of Singapore’s economy, and we look forward to sharing our knowledge and expertise with you in the months ahead. So please join us for our webinars, read our reports and editorial pieces, and stay informed about the latest developments in Singapore’s economy. You can also reach out to our Inside Sales Team here if you have any questions or are in need of specific solutions to your own housing journey.