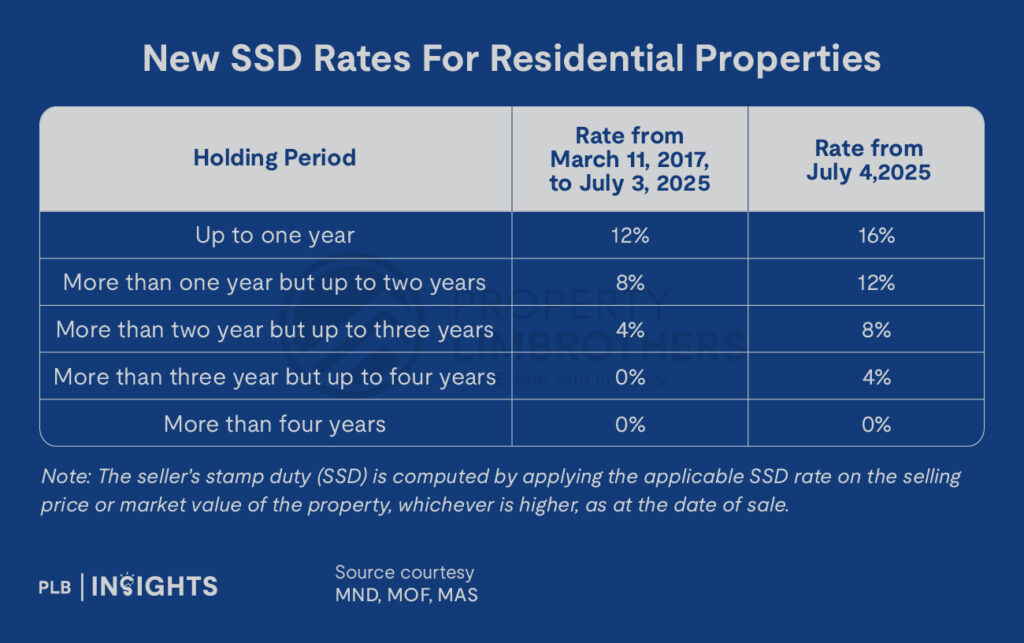

On July 4, the Singapore government raised the Seller’s Stamp Duty (SSD) rates by up to four percentage points, bringing the top rate to 16%, while extending the minimum holding period from three to four years. This move is a strategic recalibration aimed at discouraging short-term flipping, especially within the private new sale market where sub-sale transactions have spiked. Far from destabilising the broader market, this targeted intervention addresses a localized trend rooted in pandemic-era distortions.

Sub-Sale Activity: OCR at the Epicentre of the Spike

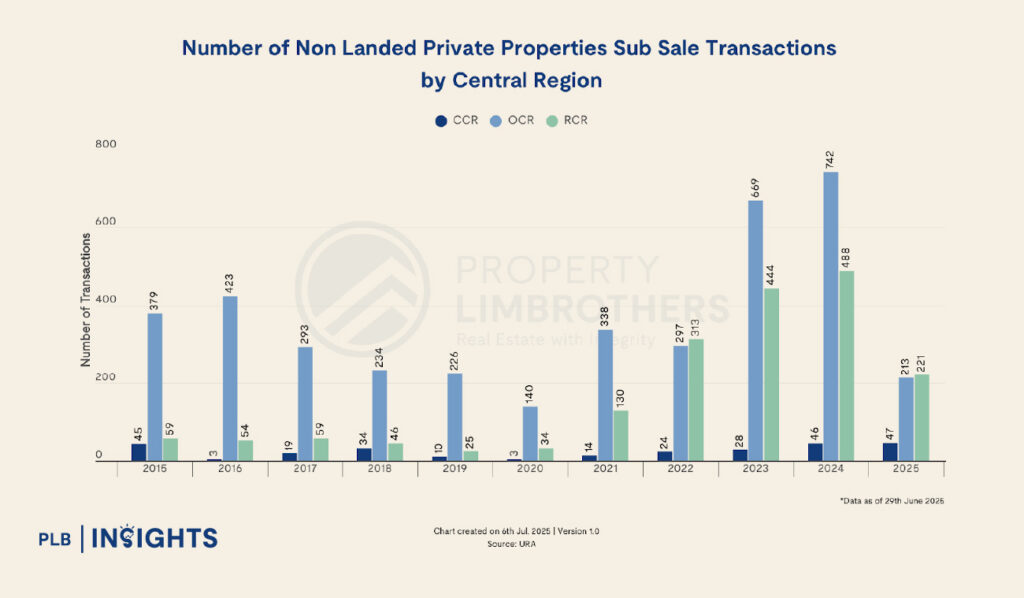

Between 2021 and 2024, sub-sale transactions surged due to delays in project completions caused by the COVID-19 pandemic. Many units bought between 2018 and 2020 only reached Temporary Occupation Permit (TOP) between 2021 and 2024, coinciding with the minimum SSD holding period of three years at the time.

A sharp increase in sub-sale transactions were seen in the Outside Central Region (OCR) segment, rising from 338 in 2021 to 742 in 2024. OCR accounted for over 60% of sub-sales during this period, reflecting its dominant role in mass-market residential supply. In contrast, the Core Central Region (CCR) and Rest of Central Region (RCR) saw more muted sub-sale volumes, underscoring the differentiated buyer profiles and motivations across segments.

Across all segments of OCR, CCR and RCR, sub-sales transaction volumes have risen since 2021.

Profitability Patterns: Timing Was Key

While many may be concerned about the potential effects of the prolonged SSD holding period, we believe the actual impact will be limited. Owners with holding periods under 3 years already constitute a negligible proportion of the resale market—only 0% to 1% annually since 2015.

More importantly, 2025 has seen a noticeable decline in the proportion of properties sold within the 3 to 4-year holding bracket, down to 14.01% from 16.03% in 2023. This suggests that the sub-sale bulge was transitory, primarily tied to the timing of pandemic-era launches reaching TOP, and is now naturally subsiding.

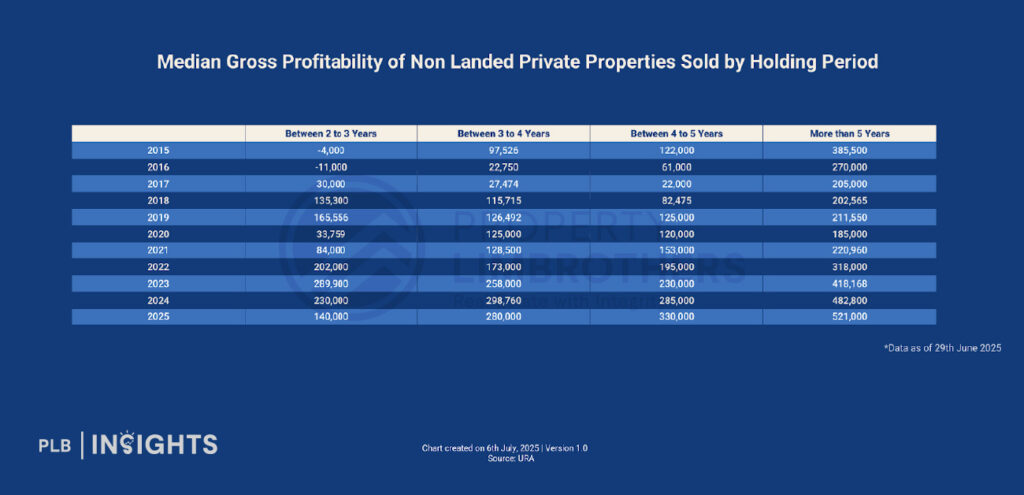

And when we look at the average profits by holding period, those with holding periods more than 5 years actually experience higher capital gains than those below 5 years.

Notably, sellers with a 4 to 5-year holding period saw increasing returns, reaching $330,000 in 2025. Those who held for more than 5 years earned the highest profits, at a median of $521,000 in 2025, reinforcing the long-term value of residential property investment.

While the recent spate of sub-sales was influenced by timing and temporary market conditions, the profitability data shows that enduring gains accrue to patient capital. Many of these recent sellers, having entered the market during the low-interest, low-price phase of 2019–2020, may not have planned short-term exits but were prompted by rapid price growth and elevated borrowing costs post-2022.

Sub-Sales Were Concentrated in a Few Projects

While sub-sales surged in volume, they were also highly concentrated. Chart 3 reveals the top ten projects that accounted for the highest number of sub-sale transactions between 2020 and 2025. Riverfront Residences led with 355 transactions, followed by Affinity at Serangoon (318), and The Florence Residences (304). These are predominantly large-scale OCR developments, each exceeding 1,000 units in size.

A key reason behind their prominence lies in timing and scale. These projects were launched during the 2018–2020 period and TOP-ed between 2021 and 2024—a window directly aligned with the expiry of the three-year SSD period.

Importantly, they were among the batch of developments most severely delayed by pandemic-era construction disruptions. As these units reached TOP, many owners who bought early found themselves at the threshold of tax-free exit amid a high-price environment.

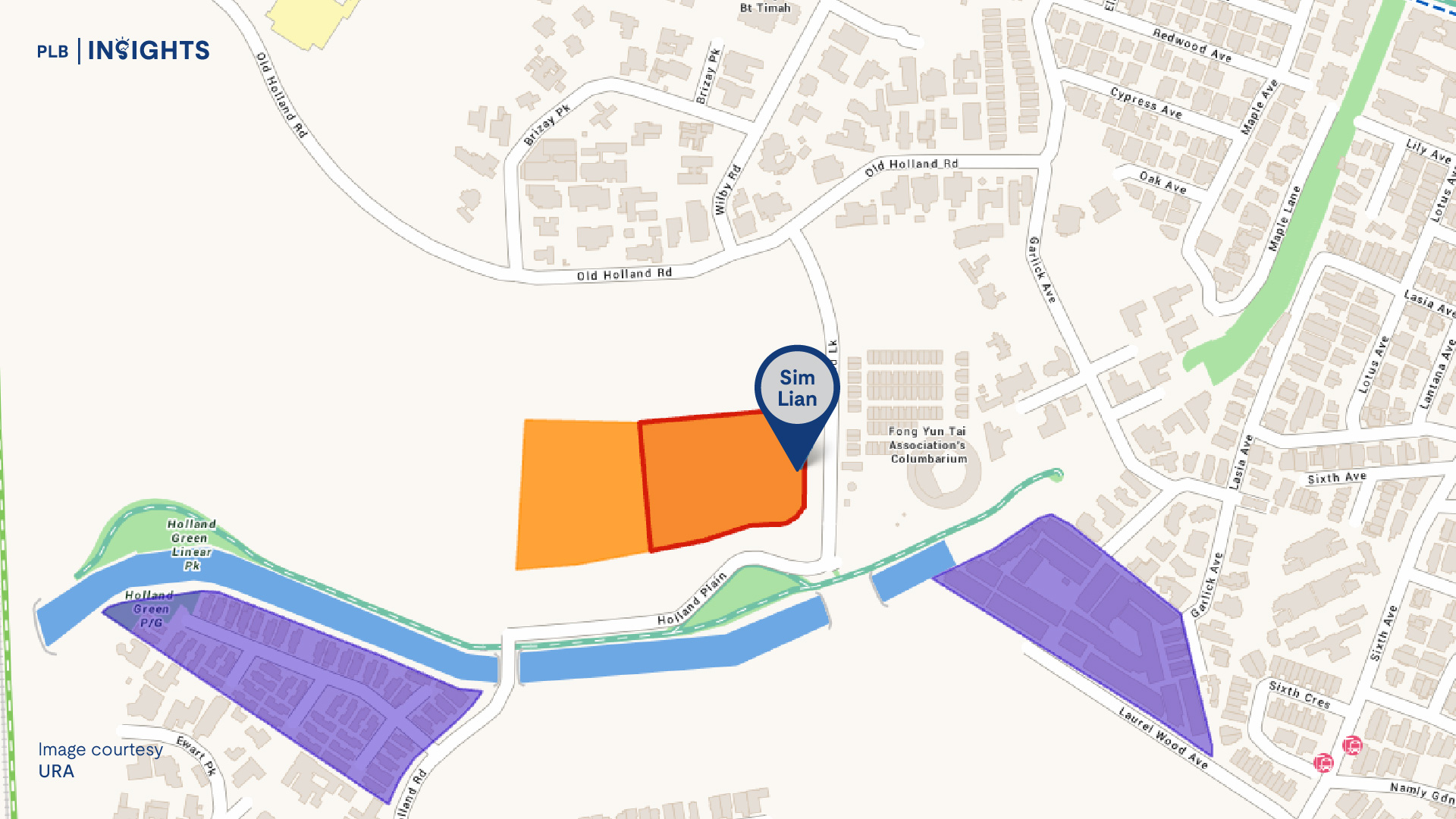

This convergence of delayed completions, a strong price recovery, and timely SSD expiry created fertile ground for sub-sale activity. The government’s SSD revision is therefore a preventive measure against the re-emergence of this concentrated behavior, especially with a large pipeline of completions due in 2026 (6,838 units) and 2027 (10,000+ units).

Evidence of Cooling: Sub-Sales Already Declining

Sub-sale activity is already tapering. From a peak of 9.5% of total private transactions in 4Q 2023, sub-sales fell to 4.4% in 1Q 2025. Concurrently, private home price growth has moderated—rising only 0.8% in 1Q 2025 compared to 2.3% in 4Q 2025—indicating that broader cooling measures are taking effect.

The data of non-landed private properties sold by holding periods further supports the trend: there was a sharp spike in sales of properties held for 3 to 4 years, reaching 10.06% and 16.03% of total transactions in 2023 and 2024, respectively. This window coincided precisely with SSD expiry for pandemic-era buyers, illustrating the behavioral impact of tax thresholds.

Long-Term Investors and End-Users Remain Dominant

Despite the recent surge in short-hold sub-sales, most transactions still originate from long-term holders. As of July 2025, 73.91% of sales involved properties held for more than five years, a slight dip from 74.46% in 2024 but still a dominant share. This suggests a stable market foundation rooted in genuine demand.

The profitability data corroborates this. Long-term holders consistently enjoyed the highest returns, with median gross profits exceeding $500,000 as at July 2025. This underscores that real estate in Singapore remains a compelling store of value for patient capital.

Conclusion: Policy Precision in a Resilient Market

The SSD revision is a precision-guided measure, aimed at curbing speculative exits in the face of rising completions. It is not a signal of systemic risk or market overreach. Instead, it addresses temporary market imbalances without compromising long-term fundamentals.

Singapore’s private residential market continues to be supported by strong end-user demand, robust income growth, and a structurally tight land supply. By refining tax policy to close emerging loopholes, the government ensures that market discipline prevails, even as the post-pandemic cycle matures.

Speculation may be deterred, but the path remains clear for genuine homeowners and long-term investors. The SSD adjustment reinforces confidence in a stable and sustainable property market.