Singapore’s real estate market has consistently demonstrated resilience and robustness, distinguishing itself from the volatility seen in other developed nations. This stability is no accident—it is the product of carefully crafted housing policies designed to balance the needs of local residents while maintaining global investor appeal. By examining these measures and contrasting them with the approaches of countries like Australia, New Zealand, the United Kingdom, and the United States, we can uncover what makes Singapore’s real estate market a benchmark of stability.

Singapore’s Key Housing Measures: The Foundation of Stability

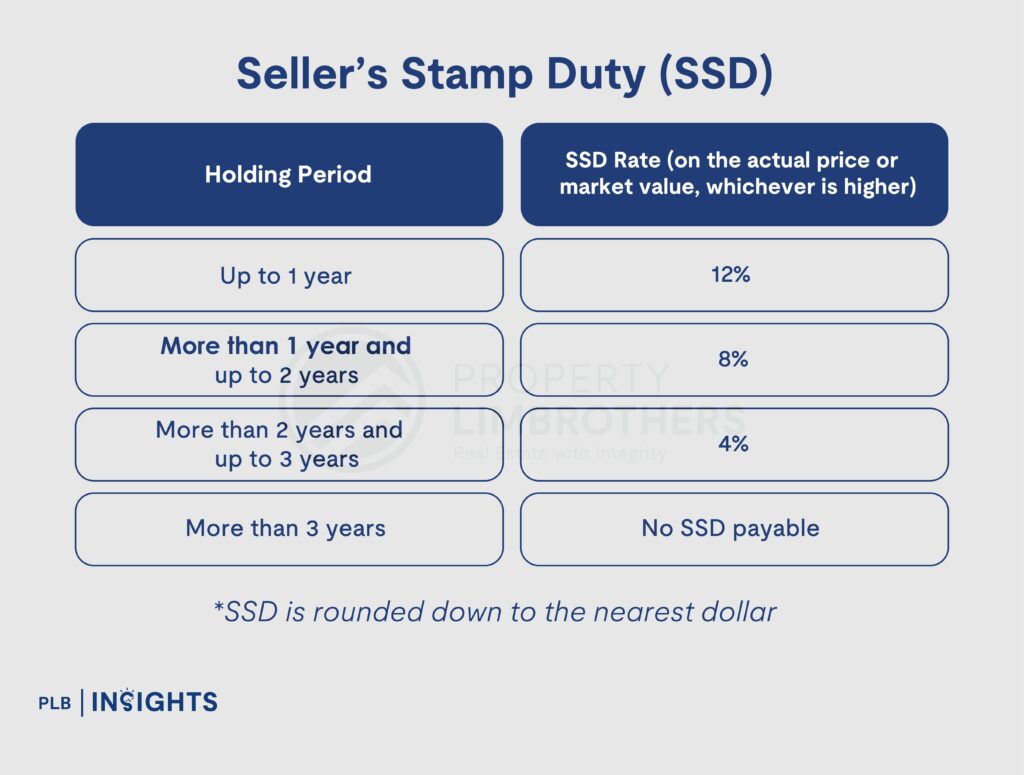

Seller’s Stamp Duty (SSD): Discouraging Speculative Flipping

Introduced in 2010, the Seller’s Stamp Duty (SSD) targets short-term property speculators. It imposes taxes on properties sold within a specific holding period:

This policy discourages speculative flipping and fosters a longer-term perspective among investors, contributing to market stability.

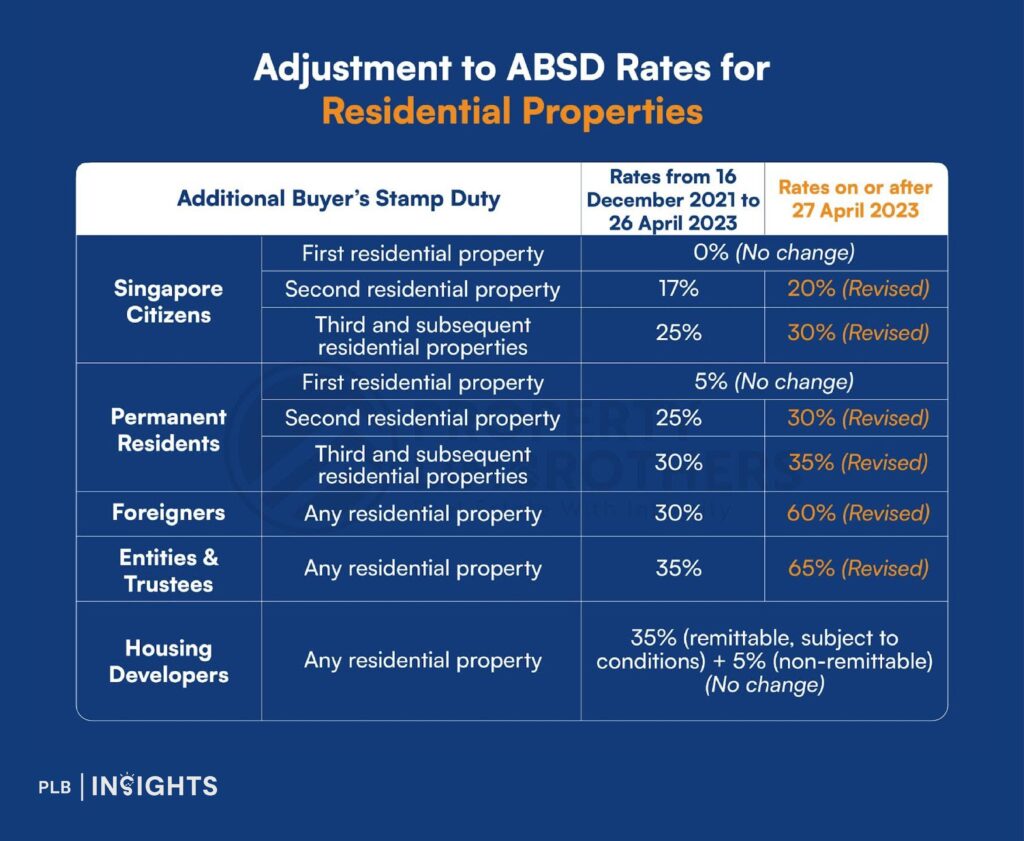

Additional Buyer’s Stamp Duty (ABSD): Managing Demand

The ABSD, introduced in 2011 and revised over time, imposes additional taxes on buyers of multiple properties and foreign purchasers. The latest ABSD rates include:

Singapore Citizens: 0% on the first property, 20% on the second, and 30% on the third or subsequent properties.

Permanent Residents: 5% on the first property, 30% on the second, and 35% on the third or subsequent properties.

Foreigners: 60% on any property purchase.

By curbing speculative demand, particularly from foreign buyers, the ABSD stabilises property prices and ensures affordability for local residents.

Total Debt Servicing Ratio (TDSR): Ensuring Financial Prudence

The TDSR framework caps the proportion of borrowers’ monthly income allocated to debt repayments at 55%. This ensures buyers remain financially prudent and prevents over-leveraging, reducing the risk of mortgage defaults.

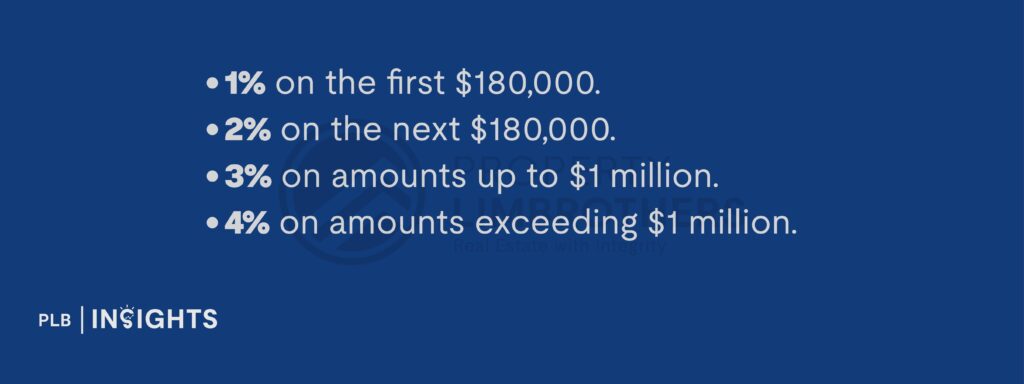

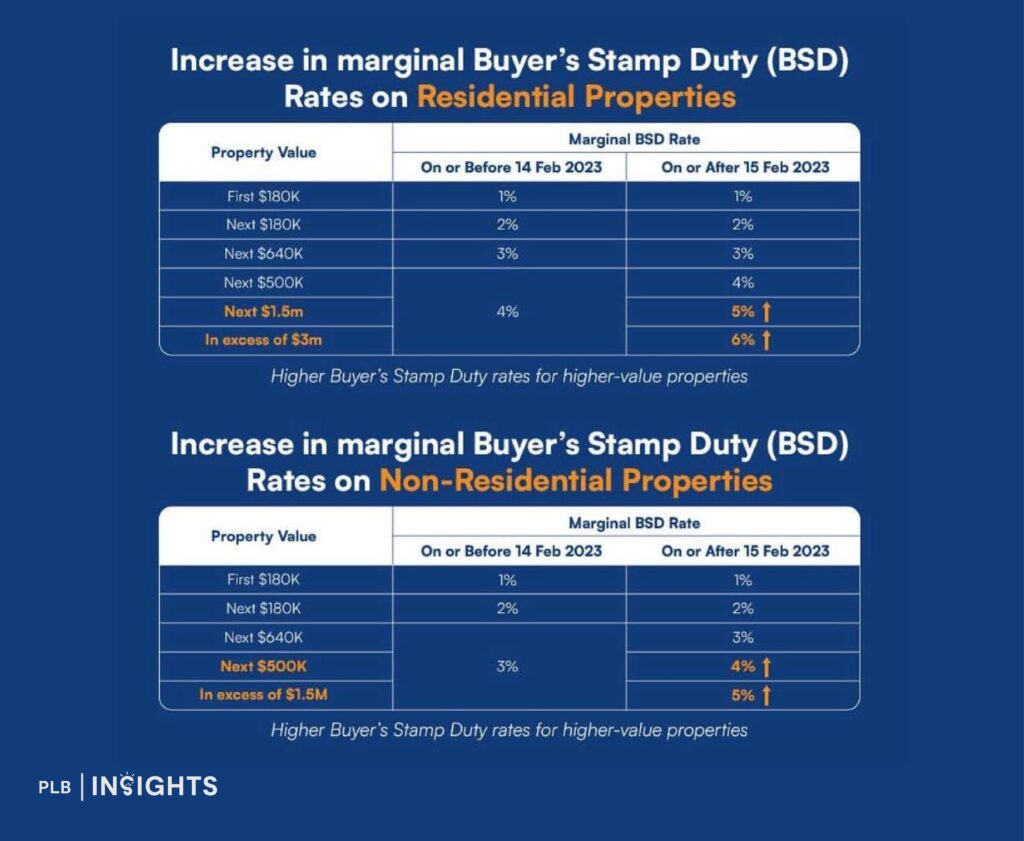

Buyer’s Stamp Duty (BSD): Supporting Market Stability

The Buyer’s Stamp Duty (BSD) is a tax levied on all property transactions in Singapore, calculated as a percentage of the property’s purchase price or market value, whichever is higher. The current rates are:

The BSD discourages speculative purchases by adding an upfront cost, promoting long-term investment and stability in the property market. Additionally, revenue from BSD supports national development initiatives, further strengthening Singapore’s real estate ecosystem.

Comparing Policies: Lessons from Other Nations

Australia and New Zealand: Housing Affordability Challenges

Australia and New Zealand have long faced housing affordability crises. In Australia, tax concessions policies like negative gearing are worsening housing policies. Negative gearing applies when the cost of owning an investment outweighs the rental income it generates. As a result, the owner can deduct that net loss and lower their total taxable income, and hence reduce their tax bill.such benefits stokes housing demand, inflating property prices and sidelining first-time buyers. In Sydney, property costs are 13.8 times the median household income, making it one of the least affordable cities globally.

New Zealand has grappled with skyrocketing property prices, particularly in Auckland, leading to the introduction of foreign buyer bans and tax reforms. However, these measures lack the depth and cohesion of Singapore’s policies, leaving affordability as a persistent issue.

United Kingdom: Regional Disparities and Volatility

The UK’s housing market exhibits significant regional disparities. London and the Southeast experience high demand and price appreciation, while the North lags. The absence of robust cooling measures has left the market prone to cyclical volatility. Recent data showed UK house prices rising by 1.2% in November 2024, but this growth is uneven and dependent on regional dynamics.

United States: Speculation and Market Corrections

The 2008 financial crisis exposed the dangers of lax lending practices in the United States. While subsequent reforms like the Dodd-Frank Act improved lending standards, the market remains vulnerable to speculative cycles. The growth of Real Estate Investment Trusts (REITs) and the “build-to-rent” model have further complicated affordability issues.

Impact of Stringent Measures on Singapore’s Appeal

Despite stringent measures like the ABSD, Singapore’s real estate market remains attractive to global investors. The city-state’s stability, transparent legal framework, and high quality of life make it a prime destination for high-net-worth individuals (HNWIs) and institutional investors. While the ABSD has reduced the volume of foreign transactions—from 1,054 units between May 2022 and April 2023 to 321 units in the subsequent 12 months—the value of these transactions remains high, highlighting the enduring appeal of Singapore’s real estate.

The vast majority of real estate transactions are driven by Singaporean buyers, who accounted for approximately 80.3% of private home purchases in 2023.

This robust local demand is underpinned by the substantial wealth of Singaporeans; in 2023, the average net worth per adult was $516,991 (US$382,957), reflecting a strong financial capacity to support the real estate market.

Singapore ranks among the top global destinations for ultra-high-net-worth individuals due to its reputation as a financial hub and its stable political environment. Prime districts such as 9, 10, and 15 continue to attract significant attention including foreign buyers, reinforcing the market’s global appeal.

Housing Grants: Enhancing Affordability and Market Stability

Singapore’s government has implemented various housing grants to assist citizens in purchasing HDB homes, thereby promoting affordability and contributing to the stability of the real estate market. These grants are primarily targeted at first-time homebuyers and are designed to make housing more accessible. This injection of funds into the real estate market also indirectly boosts the private property sector, as HDB dwellers eventually upgrade to private homes, sustaining demand across market segments.

Enhanced CPF Housing Grant (EHG)

The Enhanced CPF Housing Grant (EHG) is a key initiative designed to provide first-time homebuyers with additional financial support on top of other CPF Housing Grants. It aims to ensure that affordable housing remains accessible to lower- and middle-income households by offering extra financial assistance based on household income and flat type.

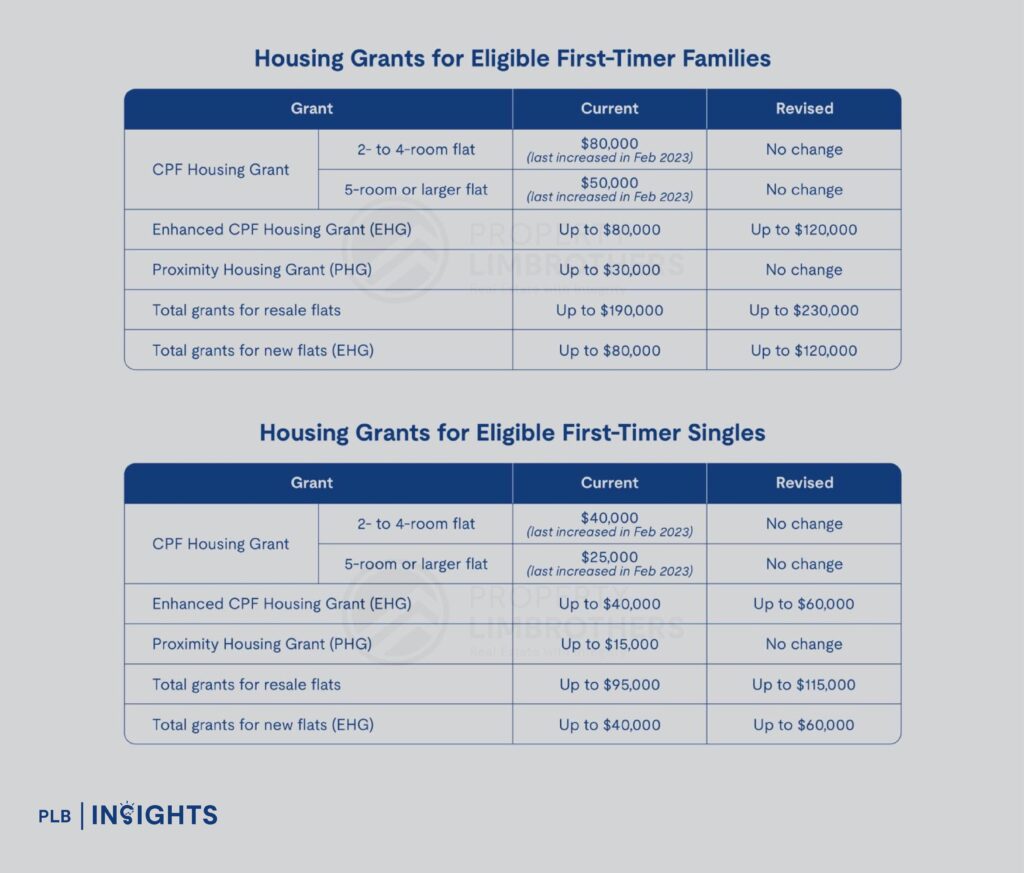

The latest figures, effective from August 2024, offer:

What sets the EHG apart is that it complements other grants such as the Family Grant and Proximity Housing Grant, providing a cumulative benefit to first-time homebuyers buying a resale HDB flat. This holistic approach ensures that the financial burden of purchasing a home is significantly reduced while encouraging family support.

Impact on the Real Estate Market

These grants have a dual effect: they make homeownership more attainable for Singaporeans and stimulate demand in the housing market. To address potential concerns about higher resale flat prices in popular locations, the government has implemented measures such as subsidy clawbacks, ensuring affordability is balanced with market stability. Ongoing monitoring remains essential to maintaining this equilibrium.

Housing Supply Dynamics: Balancing Public and Private Sectors

Singapore’s real estate market is characterised by a strategic approach to housing supply, effectively balancing public and private sector needs. The government’s proactive measures ensure a steady provision of housing, maintaining market stability and affordability.

Public Housing Supply

The Housing & Development Board (HDB) is the primary agency responsible for public housing in Singapore, accommodating approximately 80% of the resident population. To meet the growing demand, HDB has ramped up the supply of Build-To-Order (BTO) flats. In 2023, HDB launched 19,600 BTO flats, with plans to offer around 100,000 new flats between 2021 and 2025. This significant increase aims to provide affordable housing options for Singaporeans, thereby stabilising the public housing market.

Private Housing Supply through Government Land Sales (GLS)

The Urban Redevelopment Authority (URA) manages the Government Land Sales (GLS) Programme, a key mechanism for releasing state land for private development. The GLS Programme operates on a biannual basis, featuring two lists:

Confirmed List: Sites scheduled for sale at predetermined dates, providing a steady pipeline of land for development.

Reserve List: Sites made available for application; a site is put up for tender when a developer’s minimum price offer is accepted by the government.

In 2024, the Confirmed List supply of private housing units was increased to 11,100 from 9,250 units in 2023 and 6,290 units in 2022. This marked the highest supply on the Confirmed List since the second half of 2013. The government continues to monitor market conditions, adjusting the GLS Programme to align with demand and ensure a sustainable private housing market.

Impact on Market Stability

By meticulously managing the supply of both public and private housing, Singapore effectively mitigates the risks of market overheating and property bubbles. The calibrated release of land through the GLS Programme, coupled with the substantial provision of public housing, ensures that housing supply aligns with demand, maintaining affordability and market equilibrium.

This strategic approach serves as a model for other developed nations grappling with housing supply and affordability challenges. Singapore’s experience underscores the importance of proactive governance and meticulous planning in fostering a resilient and stable real estate market.

Comparative Analysis: Housing Grants in Other Developed Nations

Australia

Australia has implemented various schemes to assist first-time homebuyers, such as the First Home Owner Grant (FHOG), which provides a one-time payment to eligible buyers. The amount varies by state and territory, with additional benefits for purchasing new homes. However, critics argue that such grants can inflate property prices by increasing demand without addressing supply constraints.

New Zealand

New Zealand offers the First Home Grant, providing up to NZ$10,000 for individuals purchasing newly built homes and up to NZ$5,000 for existing homes. Despite these efforts, the country faces significant housing affordability challenges, with property prices outpacing income growth.

United Kingdom

The UK government introduced the Help to Buy scheme, offering equity loans to first-time buyers and existing homeowners purchasing new-build properties. While this initiative has helped some buyers, it has also been criticised for contributing to higher house prices and primarily benefiting developers.

United States

In the U.S., housing assistance programs vary by state, with some offering down payment assistance or tax credits for first-time homebuyers. For example, proposals have been made to provide grants up to US$25,000 for eligible buyers. However, such programmes can lead to increased demand, potentially driving up property prices if not paired with measures to boost housing supply.

In Conclusion

Singapore’s real estate market stands as a model of resilience, driven by its strategic housing policies and proactive governance. Measures like the SSD, ABSD, and TDSR have curbed speculative activities while maintaining the market’s global appeal. Compared to the housing crises and volatility seen in Australia, New Zealand, the United Kingdom, and the United States, Singapore’s cohesive approach offers valuable lessons for sustainable growth.

The city-state’s unique ability to balance affordability for its residents with attractiveness to global investors underscores its status as a premier real estate market. As Singapore continues to innovate and adapt, its real estate market will likely remain a beacon of stability in an increasingly uncertain world.

Curious about what makes Singapore’s real estate market so resilient? Let our team of experts help you navigate the policies and opportunities that set it apart. Whether you’re exploring your next property investment or planning to upgrade your home, we’re here to provide insights tailored to your needs. Contact us today to learn more!