The Singapore property market continues to showcase a robust appetite for new launch condominiums, even in the face of rising costs and cooling measures. In November 2024, two highly anticipated projects, Emerald of Katong and Chuan Park, hit the market with a splash. Over two weekends, these launches contributed heavily to over 2,100 new condo transactions, challenging the prevailing perception that housing in Singapore has become increasingly unaffordable.

This trend raises a key question: Why are new launches so attractive to property buyers in Singapore? Despite higher prices and longer waiting times for completion, many buyers remain steadfast in their preference for newly launched projects over resale properties. From modern amenities and investment potential to flexibility in choosing unit layouts, there are distinct advantages driving this preference.

In this article, we explore the factors behind the enduring appeal of new launch properties and uncover the reasons why buyers gravitate toward them. Whether you’re a first-time buyer, an upgrader, or an investor, understanding these motivations can help you make an informed decision in Singapore’s competitive real estate market.

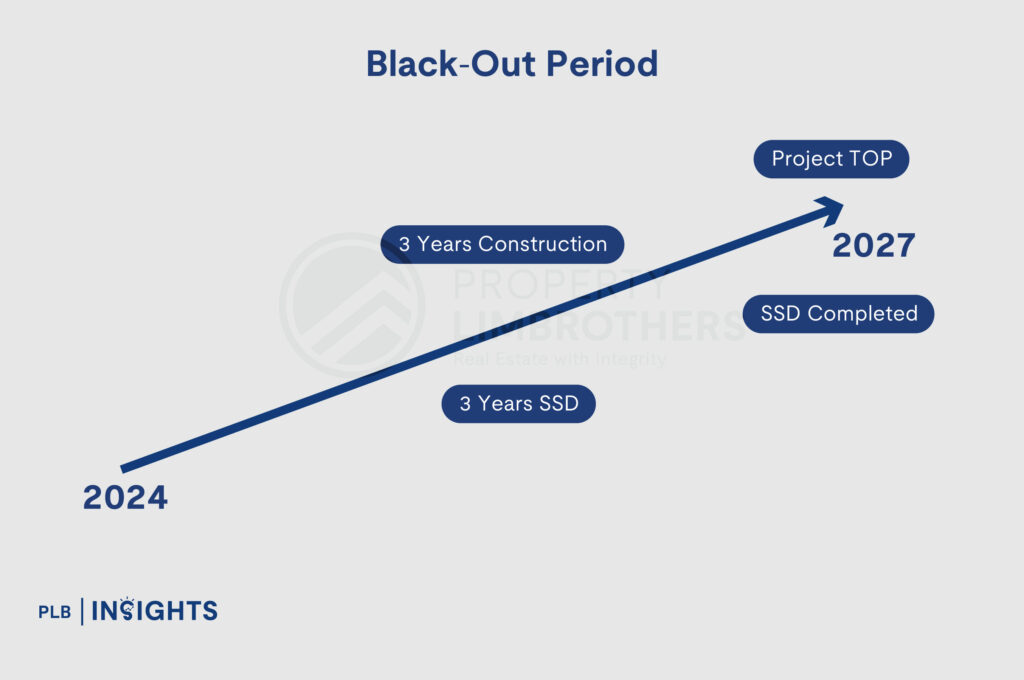

The Black-Out Period: A Built-In Advantage for New Launch Buyers

A unique advantage of new launch properties is the Black-Out Period, a concept that combines psychological discipline with structural safeguards to help buyers avoid impulsive decisions. This effect is similar to investing in fixed-term instruments like fixed deposits or bonds with a maturity period, where funds are locked in for a set duration, reducing the temptation to react to short-term market fluctuations.

In volatile investments such as stocks, investors are constantly exposed to daily price movements, which can lead to emotional decision-making. For instance, a sudden price surge might cause FOMO (Fear of Missing Out), prompting impulsive buying at a peak, while a sharp dip could trigger panic selling at a loss. Over time, these reactionary moves often erode potential gains, as they disrupt the natural appreciation of the asset.

New launch properties shield buyers from these pitfalls through their construction timeline, which typically spans three to four years. During this period, the property is neither ready for occupation nor immediate resale (sub-sale transactions do happen, but not without paying additional taxes), creating a Black-Out Period that removes the option for short-term trading. This enforced waiting period encourages buyers to hold their investment, allowing the property to appreciate naturally in value without interference from market noise.

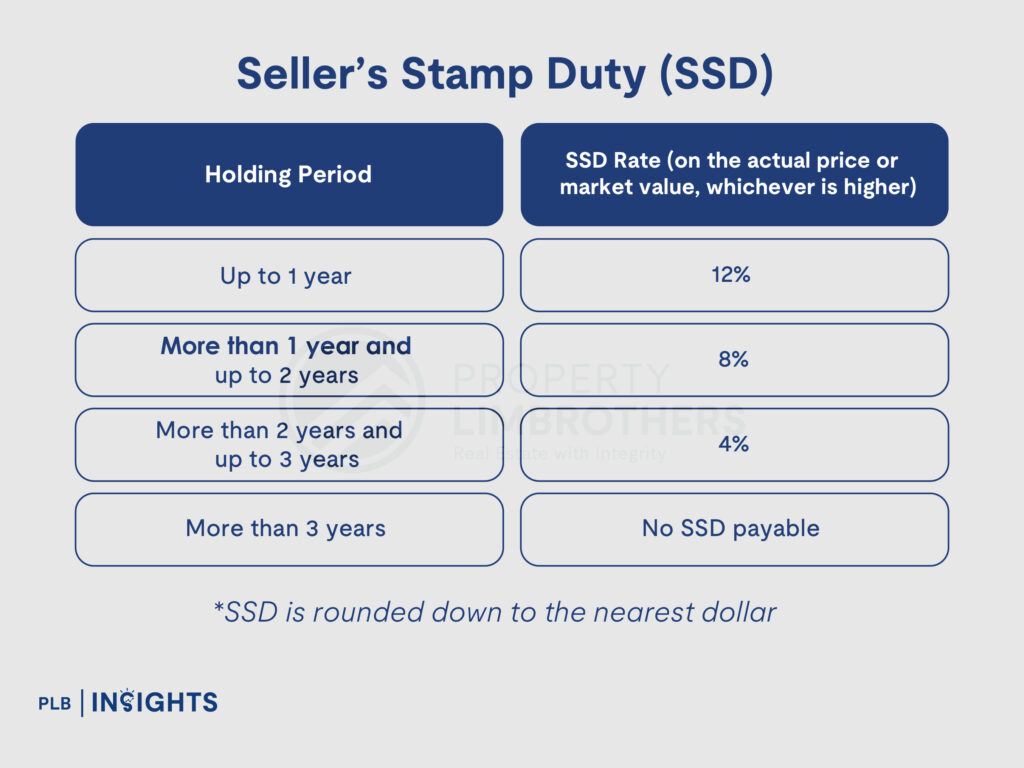

This advantage is further reinforced by Singapore’s Seller’s Stamp Duty (SSD), which imposes hefty taxes on properties sold within three years of purchase to deter speculation. Conveniently, the SSD period aligns with the typical construction timeline of new launches. By the time the property receives its Temporary Occupation Permit (TOP), the SSD liability has expired, providing buyers with greater flexibility to sell, rent, or occupy their unit. By then, the property has often appreciated in value, benefiting from the market’s demand for move-in-ready homes.

This combination of construction timelines and the SSD window acts as a natural barrier to impulsive selling, encouraging buyers to adopt a long-term perspective. The Black-Out Period provides new launch investors with a time-tested strategy to grow their wealth in a disciplined and less emotionally charged manner, aligning with Singapore’s stable and appreciating property market. For those seeking a structured approach to property investment, new launches offer a compelling opportunity.

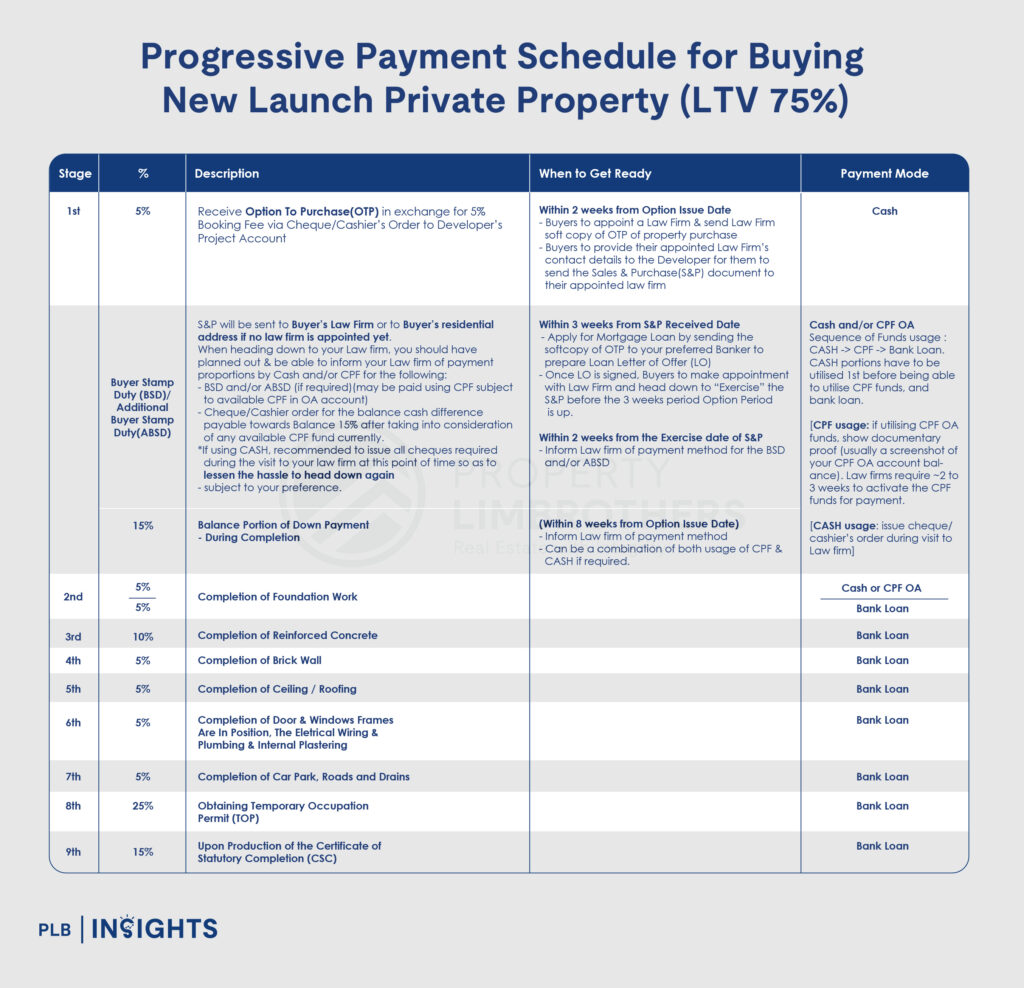

Gradual Dollar-Cost Averaging Through Progressive Payments

One of the most significant advantages of investing in new launch properties is the progressive payment scheme, which spreads the financial commitment across the construction period, typically three to four years. This payment structure offers buyers a manageable and less financially burdensome approach to property investment, especially compared to purchasing resale properties, where the full purchase price must be paid upfront.

Staggered Payments for Manageable Cash Flow

Under the progressive payment scheme, buyers pay for the property in instalments tied to specific construction milestones. For instance, payments are made in phases such as the completion of the foundation, structural framework, or roofing. This staggered schedule allows buyers to spread their financial outlay over several years instead of making a single, large lump-sum payment. This is particularly beneficial for individuals who want to balance property investment with other financial commitments, such as children’s education, savings, or existing loans.

Optimising CPF Usage

Many buyers can utilise their CPF savings to cover most of these payments, significantly reducing the amount of cash needed upfront. With each milestone payment typically spaced months apart, buyers have ample time to replenish their CPF Ordinary Account through monthly contributions, creating a revolving fund that helps manage payments more effectively. This process reduces the immediate strain on personal cash reserves, making property investment more accessible to a wider range of buyers.

A Built-In Dollar-Cost Averaging Mechanism

The progressive payment system effectively acts as a dollar-cost averaging mechanism, a strategy that involves investing fixed amounts over time to mitigate market volatility. By making payments over the construction period, buyers essentially “buy into” their property in a phased manner, reducing the risks associated with committing the full quantum upfront. This strategy is especially relevant in a market where property values are expected to rise steadily, allowing buyers to benefit from gradual price appreciation during the construction phase.

Minimising Financial Stress

Unlike resale properties, where buyers must secure financing and pay the full price within a short timeframe, new launches provide a more relaxed financial schedule. This reduces the stress associated with managing large sums of money and offers buyers the flexibility to adjust their finances as needed over the course of construction. For investors, this also means they can allocate resources toward other opportunities while still building equity in their property.

Building Equity Before TOP

By the time the property reaches TOP, buyers will have paid the bulk of the purchase price while the remaining balance can be settled through a bank loan or CPF. This progressive approach ensures that buyers steadily build equity in their property, positioning them for a smoother transition into ownership or rental income generation once the property is completed.

Flexibility at TOP: Move, Rent, or Sell

When a new launch property reaches its TOP stage, buyers gain a level of flexibility unmatched by many other property investments. By this point, the typical SSD period of three years has also expired, removing the additional tax burden on resale transactions. This opens up three primary options for property owners, each catering to different financial goals and lifestyle needs.

Move-In and Enjoy Modern Living

For owner-occupiers, TOP marks the moment they can move into their new home. New launch properties are designed with the latest architectural trends and feature state-of-the-art amenities, offering a modern and comfortable living experience. The brand-new condition of the property means minimal maintenance costs in the first few years, and residents can enjoy facilities such as gyms, pools, and recreational spaces that align with contemporary urban lifestyles. This is particularly appealing to buyers who prioritise convenience, exclusivity, and the pride of owning a home that has never been lived in before.

Rent Out for Immediate Passive Income

For investors, renting out the property at TOP is often a highly lucrative option. Newly completed properties command a premium in the rental market, as tenants are often willing to pay more for units that are move-in ready, modern, and equipped with cutting-edge facilities. These properties are particularly attractive to expatriates, professionals, and families who prefer new homes but may not wish to wait for construction to complete. By renting out the property, investors can begin generating passive income almost immediately, creating a steady cash flow while holding onto an appreciating asset.

Sell and Realise Capital Appreciation

For those looking to liquidate their investment, selling at or shortly after TOP can be a profitable move. By this time, the property has often appreciated in value due to the natural price growth during the construction period and the rising demand for brand-new, ready-to-move-in units. Additionally, buyers in the resale market who were unwilling to commit to a new launch during its early stages often turn to TOP properties as an alternative. These buyers are drawn to the convenience of immediate occupation without the waiting period for construction, creating a robust demand pool for the property.

The Power of Strategic Choice

The flexibility at TOP offers a significant advantage for buyers, as it allows them to adapt their strategy based on market conditions, financial goals, and personal needs. Whether it’s capitalising on rising rental yields, enjoying the perks of a modern home, or taking advantage of price appreciation in a buoyant market, buyers are empowered to make decisions that maximise the value of their investment.

This level of control and adaptability is one of the reasons why new launch properties are so attractive to both investors and homebuyers. By aligning the completion of the construction period with the expiration of the SSD, buyers are uniquely positioned to leverage the property’s full potential at the most opportune moment.

A Brand-New Asset Class with High Appeal

Owning a brand-new property offers a unique set of advantages that make new launch properties particularly attractive to investors and homebuyers alike. Beyond the practical benefits of modern design and low maintenance, the allure of a freshly completed unit caters to a distinct and growing market segment that values exclusivity and immediate usability.

Appealing to TOP Buyers: The Freshness Factor

One of the most significant advantages of owning a new launch property is its ability to attract a unique group of buyers and renters often referred to as TOP buyers. These individuals prioritise properties with no prior occupants, preferring the pristine condition of a brand-new home. They often avoid resale properties due to concerns over wear and tear, outdated designs, or the need for renovations.

TOP buyers are typically unwilling to wait for ongoing constructions to complete, making newly TOP-ed properties an attractive alternative. This demand creates a robust secondary market for new launch investors, who can market their units to this audience at a premium price.

Higher Rental Demand and Premium Pricing

Brand-new properties also command higher rental yields compared to older units. Tenants—especially expatriates and young professionals—often prioritise newly completed condos for their modern amenities, updated layouts, and superior living standards. For these renters, the appeal of move-in-ready homes with the latest facilities, such as co-working spaces, smart home features, and eco-friendly designs, justifies paying a higher rent.

The freshness factor of a new property eliminates concerns about maintenance or hidden issues, which are more prevalent in older units. This not only enhances the tenant experience but also provides landlords with lower maintenance costs in the initial years of ownership.

Market Differentiation and Competitive Advantage

In a competitive property market, owning a brand-new asset gives investors an edge. New launch properties are designed with the latest market trends and buyer preferences in mind, from efficient layouts to smart technology integration. This modernity differentiates them from older properties, making them easier to sell or rent at a premium.

Moreover, the lack of wear and tear in a new property adds to its value proposition. Buyers in the resale market who are wary of potential renovation costs are more likely to gravitate toward a newly completed unit, further enhancing its attractiveness and marketability.

Minimal Maintenance and High Durability

Another key benefit of new launch properties is the low maintenance costs during the first few years of ownership. Since all fixtures, fittings, and systems are brand new and often under warranty, owners can avoid the immediate costs of repairs or replacements typically associated with older properties. This not only reduces financial strain but also ensures a hassle-free ownership experience for both buyers and tenants.

Catering to Future Trends

Owning a brand-new property positions investors and homeowners to benefit from evolving trends in real estate. New launches are designed with a forward-looking approach, incorporating features such as eco-friendly designs, smart home technology, and communal living spaces that cater to the preferences of modern buyers and tenants. As these trends continue to grow, brand-new properties are likely to retain their appeal and command a premium in both resale and rental markets.

Closing Thoughts

New launch properties remain a compelling choice for investors and homebuyers in Singapore, offering a unique combination of modern amenities, progressive payment schemes, and flexibility upon completion. Their ability to cater to diverse buyer profiles—from first-time homeowners to seasoned investors—makes them a cornerstone of Singapore’s dynamic property market.

However, the attractiveness of any new launch hinges on the price disparity between its PSF and quantum price relative to comparable projects in the district and region. This is where savvy buyers must evaluate the value proposition carefully, taking into account market trends, resale options, and the potential for capital appreciation in the chosen enclave.

For buyers who prioritise the benefits of owning a brand-new asset and appreciate the convenience of progressive payments, new launches offer a balanced and strategic investment option. Whether the goal is to move in, rent out, or resell at TOP, these properties provide the flexibility and potential to meet a wide range of financial and lifestyle objectives.

Ultimately, the enduring appeal of new launches lies in their ability to combine affordability, modernity, and market potential. By choosing the right project in the right location, buyers can maximise their investment returns while enjoying the benefits of owning a property designed for today’s demands and tomorrow’s opportunities.

Let’s get in touch

Looking to invest in a new launch property or navigate Singapore’s property market with confidence? We are here to guide you every step of the way! From detailed market insights to personalised advice, we ensure you make informed decisions that align with your financial goals.

Contact us here today to explore the best new launch options and unlock opportunities tailored to your needs. Let us help you find your next home or investment property with ease!