Pure landed properties in Singapore have long been a symbol of exclusivity and a hallmark of sound investment. With approximately 73,500 landed properties making up only about 4.8% of the housing stock in Singapore, it is no surprise that these assets are highly sought after. District 15 (D15), in particular, continues to be a hotbed for real estate interest, offering a mix of heritage and luxury. However, for prospective buyers, understanding the significance of the entry price point is essential, especially when it comes to pure landed homes in this coveted district.

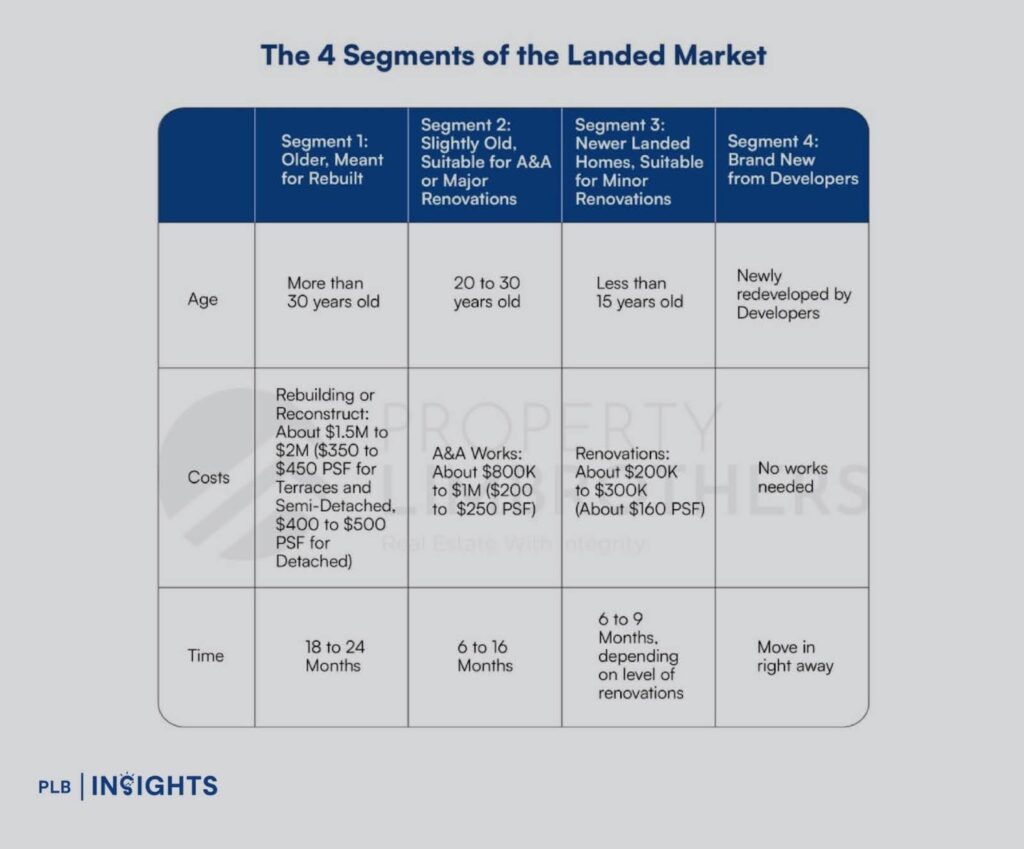

In this article, we delve into the significance of the entry price point for various landed property types—inter-terrace, semi-detached, and detached homes—and how each category (from rebuild-ready to move-in ready) impacts the potential for long-term financial growth. We also explore how costs related to renovations, Additions & Alterations (A&A), or full-scale rebuilds can transform these properties and boost their value, helping buyers achieve the full potential of their investment in D15’s pure landed market.

The Importance of Entry Price Point

When buying a property, the entry price point is a key factor that can greatly influence the financial returns you achieve over time. This is especially true for pure landed homes, which come with higher upfront costs compared to other property types like condominiums or HDB flats. The price at which you enter the market can either accelerate your property’s value growth or limit its appreciation potential. Making a purchase at the right entry point can lead to significant capital gains, while overpaying can hinder the property’s ability to grow in value.

Unlike non-landed properties, landed homes present unique opportunities and risks. Investing at the right price point can set the stage for significant capital gains, whereas overpaying for a property may result in limited upside potential or prolonged periods of stagnant growth. This is especially true for District 15, where price sensitivity becomes crucial due to the luxury status and high quantum involved.

Understanding D15’s Landed Property Landscape

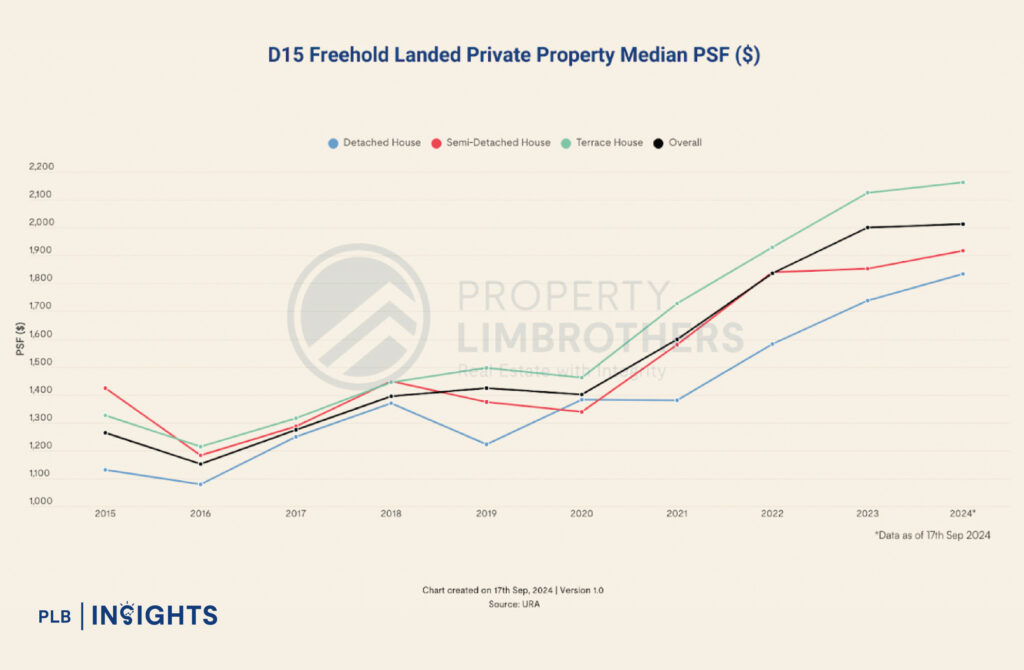

D15 has consistently been one of the most desirable areas for discerning pure landed property buyers, largely due to its location within the Rest of Central Region (RCR), strategic proximity to the Central Business District (CBD), and the lifestyle it offers. Pure landed homes in D15 have shown a strong track record of capital appreciation, with the overall compounded annual growth rate (CAGR) standing at 5.3% from 2015 to 2024.

However, not all landed properties are created equal. The type of landed property—whether inter-terrace, corner terrace, semi-detached, or detached—plays a significant role in determining the initial investment and the long-term return. For example, detached homes in D15 saw the highest CAGR of 5.5%, compared to 5.3% for terrace houses and 3.4% for semi-detached. This disparity highlights the importance of choosing the right property type at the right entry price to maximise returns.

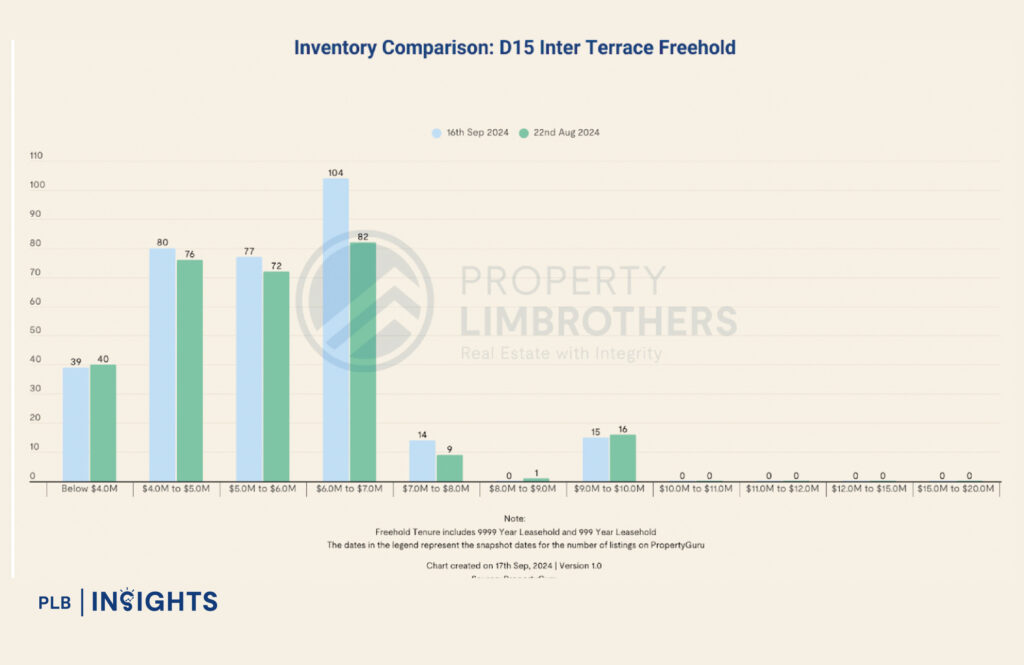

Entry-Level Landed Properties: Inter-Terraces and Their Potential

Inter-terrace houses are typically considered the entry-level option for those looking to invest in pure landed properties. Within District 15, inter-terrace homes offer relatively more affordable price points compared to semi-detached and detached houses. According to our research, 84% of inter-terrace listings fall within the $4 million to $8 million range, with the highest concentration between $6 million and $7 million. This makes inter-terraces a viable option for buyers seeking a landed investment without the hefty price tag associated with larger property types.

However, even at these price levels, buyers must carefully assess the property’s inherent characteristics and potential for value enhancement. A well-located inter-terrace house with good DNA (i.e., properties with desirable inherent characteristics such as proximity to amenities and schools) can offer significant upside.

Semi-Detached and Detached Homes: Higher Entry, Greater Payoff?

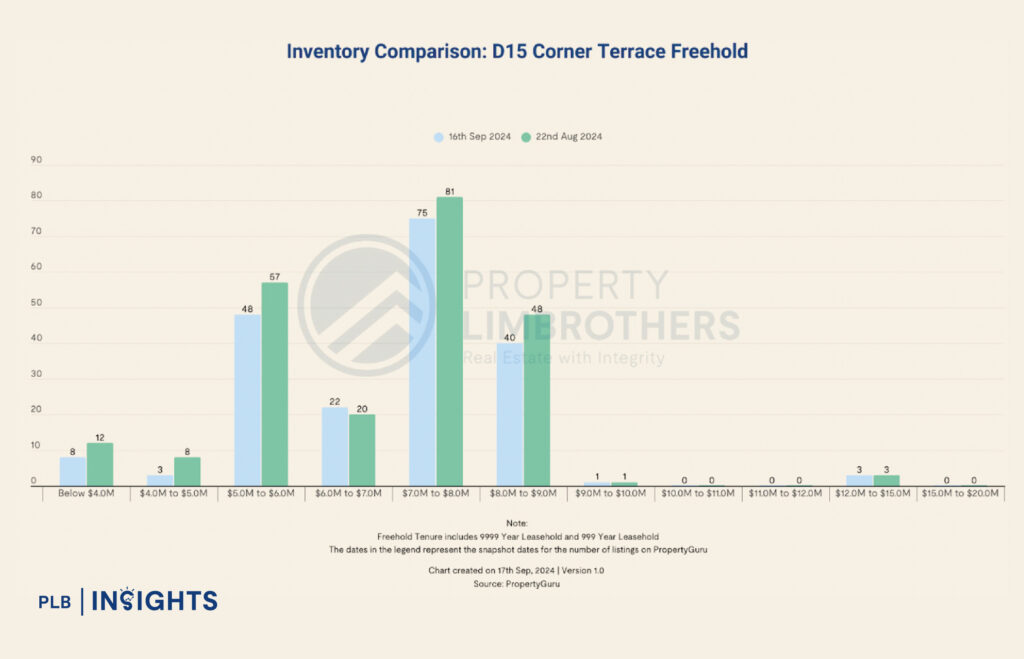

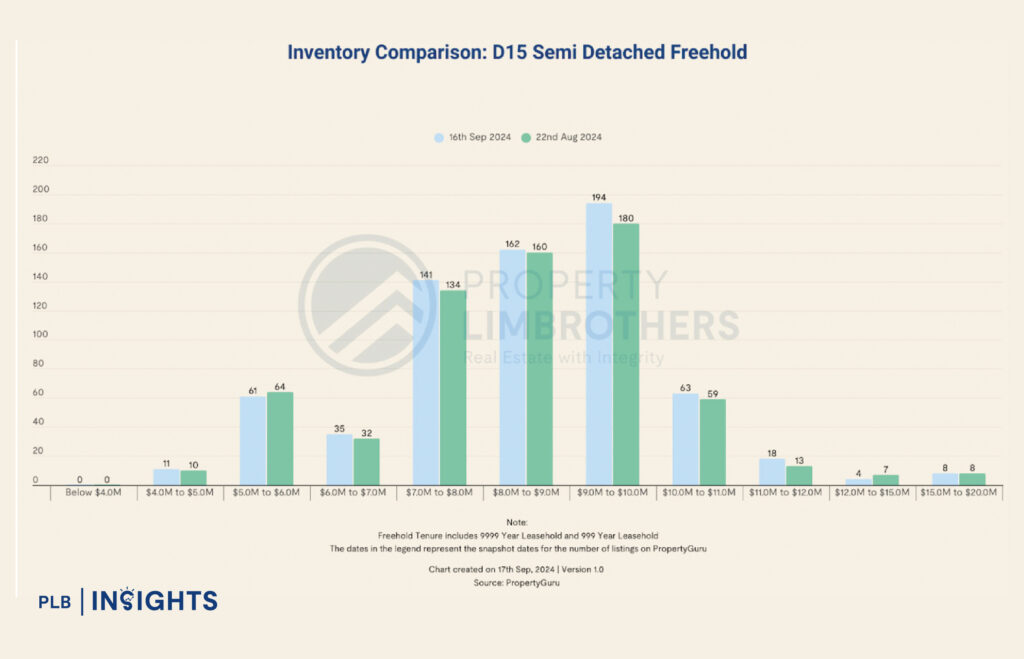

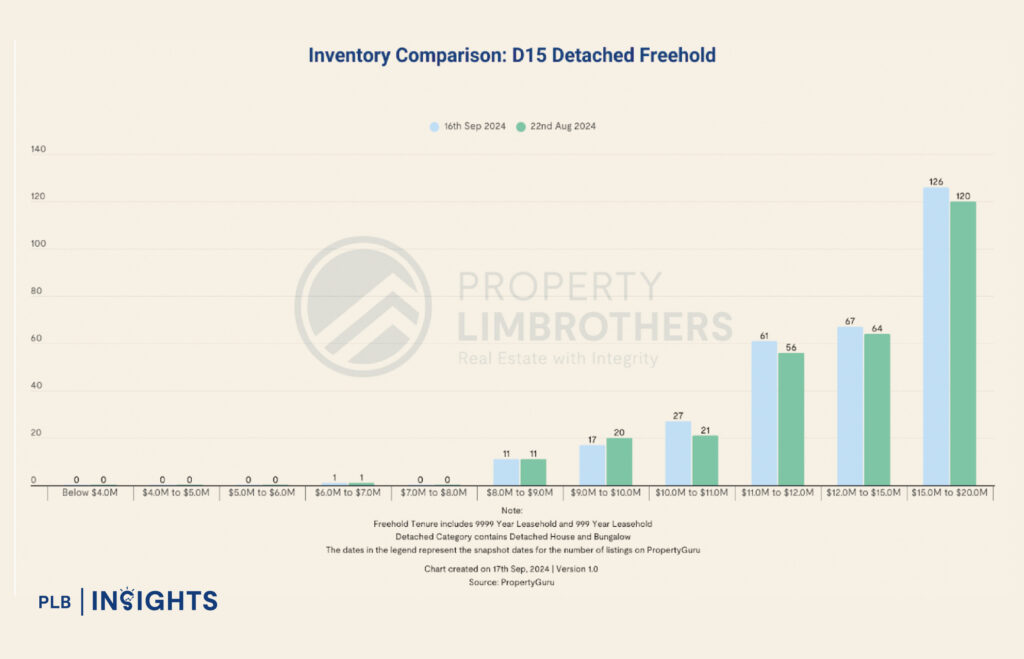

While semi-detached and detached homes come with higher entry prices, they also offer the potential for greater long-term appreciation. Semi-detached houses in D15 typically range from $5 million to $14 million, with a significant number of listings priced between $9 million and $10 million. Detached houses, on the other hand, command even higher price points, with 41% of listings in the $15 million to $20 million range.

For high-net-worth individuals, these properties not only offer space and luxury but also the opportunity to benefit from limited supply. As noted in the report, detached homes have shown the highest price growth over the past decade, reflecting their enduring appeal in the luxury segment.

However, the key to ensuring a sound investment lies in not overpaying at the point of entry. Buyers should be mindful of the inventory levels and absorption rates, which provide insights into the supply-demand dynamics for each property type. For example, the absorption ratio for semi-detached homes is 99.7 months, indicating a longer time to sell due to higher inventory levels. Conversely, terrace homes, with an absorption ratio of 48.1 months, offer a more liquid investment, potentially resulting in quicker capital appreciation.

The Role of PropertyLimBrothers’ Four Horses DNA Framework

To guide prospective buyers in making informed decisions about pure landed properties, PropertyLimBrothers developed an approach with our proprietary Four Horses DNA framework. This methodology provides a clear way to evaluate the inherent characteristics of a pure landed property, which are often unchangeable or significantly difficult to alter. The framework serves as a powerful tool to gauge both the current and potential long-term value of a property.

The Four Horses DNA framework categorises properties based on their inherent characteristics (such as location, accessibility, and surrounding amenities), and the possibility of enhancing these characteristics to maximise the property’s potential. This system divides properties into four main types: Good DNA Horse, Stellar Horse, Poorer DNA Horse, and Enhanced Horse. These classifications help buyers understand how a property’s fixed traits affect its desirability, and how strategic improvements can unlock further value.

Good DNA Horse

This category refers to properties with strong inherent characteristics (GIC). These traits typically include desirable factors like prime location, proximity to top schools, excellent connectivity, and access to lifestyle amenities. Good DNA properties are free from unchangeable negatives such as proximity to undesirable infrastructure or noise pollution. Homes in this category typically have strong appreciation potential even without significant alterations.

Stellar Horse

Stellar Horses are Good DNA properties that have been enhanced with value-add features (VAE). These features could include architectural upgrades, well-designed extensions, or high-quality interior refurbishments. A home in this category not only benefits from its inherent traits but also stands out in the market due to the added value brought by thoughtful renovations or Additions & Alterations (A&A).

For instance, a property in D15 with Good DNA could see its value significantly rise if the homeowner invests in a well-executed renovation, adding a second floor or expanding the living space. These enhancements make the home more attractive to buyers, ensuring it commands a higher price when sold.

Poorer DNA Horse

This category includes properties with undesirable inherent traits, such as those located near busy highways, industrial zones, or less prestigious areas. While these homes may still see value appreciation, the growth potential is typically slower compared to Good DNA properties. Buyers interested in Poorer DNA homes should be cautious, as these unchangeable factors can limit the property’s future value regardless of renovation efforts.

Enhanced Horse

Enhanced Horses are properties with Poorer DNA that have been improved with value-add features. Strategic renovations or A&A works can enhance the property’s appeal, but the extent of value appreciation will still be constrained by the original poor characteristics. For instance, adding modern extensions or upgrading interiors in a home near a noisy area might boost its market value, but it may never reach the same level as a Stellar Horse due to its less desirable location.

How the Four Horses DNA Impacts Entry Price and Investment Decisions

The Four Horses DNA framework helps buyers assess both the entry price and the potential for long-term value appreciation by evaluating a property’s DNA. A property with Good DNA will generally have a higher entry price but offers stronger capital appreciation potential with or without significant renovations. On the other hand, a Poorer DNA property will typically have a lower entry price but may not see the same level of growth, even with costly enhancements.

For example, an inter-terrace home in D15 categorised as a Good DNA Horse might be listed at $7 million but has inherent features that support long-term appreciation, making it a worthwhile investment. Meanwhile, a Poorer DNA Horse in the same area may have a lower entry price of $5 million but lacks key desirable traits, resulting in slower value growth.

Applying the Four Horses DNA in Practice

When applying the Four Horses DNA framework, buyers can use it in conjunction with PLB’s Landed Categories(which consider the property’s condition and age) to make well-rounded decisions. Understanding whether a property has Good DNA or Poorer DNA allows buyers to fine-tune their expectations regarding appreciation potential. For example:

- A Category 1 home (requiring a full rebuild) with Good DNA offers a buyer an excellent opportunity to unlock future value by upgrading the property to match its inherent characteristics.

- A Category 2 or 3 home with Stellar DNA might benefit from modest A&A work, capitalising on its already strong features to enhance resale potential.

This dual approach enables buyers to carefully weigh the initial investment against the future value potential, ensuring they make strategic choices that align with their long-term goals.

By utilising the Four Horses DNA framework, buyers can better assess landed properties in D15, ensuring their purchase aligns with both their financial objectives and the property’s long-term growth potential. Understanding these unchangeable characteristics—coupled with the potential for adding value—provides a holistic view that empowers buyers to make informed, strategic investments.

In Conclusion

The entry price point of pure landed homes, particularly in District 15, plays a pivotal role in determining the property’s potential for growth. Buyers must evaluate the type of landed property, its inherent characteristics, and location through comprehensive analysis. Leveraging tools like PropertyLimBrothers’ Landed Framework, coupled with thorough Comparative Market Analysis (CMA), can help investors identify the ideal property that aligns with their long-term financial objectives.

By focusing on the right factors—such as property condition, potential for enhancement, and market dynamics—rather than trying to time the market, buyers can make well-informed decisions. This strategic approach ensures that the property’s value will appreciate over time, making it a solid asset in Singapore’s highly resilient landed property market.