Singapore is one of the most popular destinations for expats and foreign investors due to its stable political climate, strong economy, and strategic location in Southeast Asia. As a result, our city-state has attracted a large number of foreigners who are interested in investing in its real estate market. However, buying property in Singapore as a foreigner can be a complex process, as there are various rules and regulations that govern foreign ownership. If you are a foreign buyer or investor looking to purchase a property in Singapore, we invite you to read our step-by-step guide of the whole process.

In this article, we will explore the types of properties that foreigners can buy in Singapore and the regulations surrounding foreign ownership of property.

Residential Properties: Residency Status Matters

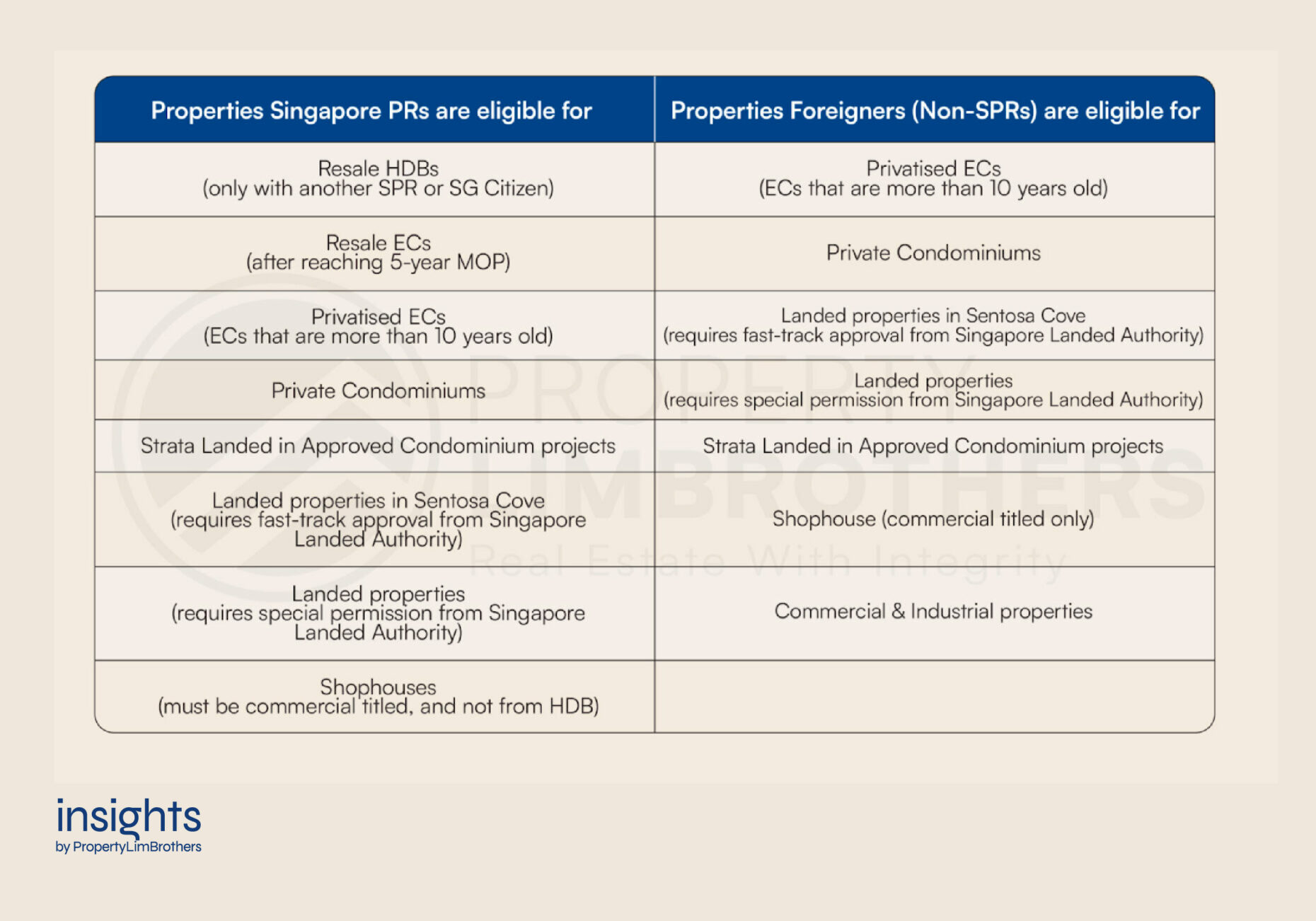

When it comes to buying a residential property in Singapore, residency status matters. According to the Residential Property Act, foreigners are permitted to own residential properties here, albeit with some limitations. Notably, there is a significant disparity between a Singapore Permanent Resident (SPR) and a foreign buyer (non-SPR), where SPRs are afforded the opportunity to purchase housing from both the public and private housing market, contingent upon certain eligibility criteria. Conversely, non-SPRs are only able to purchase properties from the private housing market.

This distinction underscores the importance of understanding the specific regulations surrounding foreign ownership of residential properties in Singapore.

In the next sections, we will break down the residential property market into public housing and private housing, highlighting which types of properties are available to foreigners and the various restrictions and eligibility criteria.

Public Housing

In Singapore, public housing refers to HDB (Housing & Development Board) flats – these are primarily flats that the government has set aside for Singapore Citizens. New HDB flats can be purchased via public housing schemes such as the Build-to-Order (BTO) or Sale of Balance Flats (SBF) exercises. Older HDB flats bought from the open market are known as resale HDB flats. New launch Executive Condominiums (ECs) also fall under this category, until they pass their 5-year Minimum Occupation Period (MOP). ECs become available to PRs after 5 years, and will be fully privatised and available to foreigners after 10 years. Foreigners who are not PRs will not be eligible to buy HDB flats.

If both parties of the couple are SPRs, they may be eligible to purchase a resale HDB flat under the Family or Fiancé Scheme, provided that they have held their PR status for at least three years. Additionally, they can opt to buy resale ECs that have already fulfilled their 5-year MOP, or ECs that are more than 10 years old.

If one of the purchasers is an SPR and the other a foreigner, they are only eligible to buy fully privatised ECs that are over 10 years old. Same with a couple consisting of two foreigners who are not SPRs.

Lastly, in cases where at least one of the couple is a Singapore Citizen (SC), more options become available. A SC and SPR couple can ballot for a Build-to-Order (BTO)/Sale of Balance Flats (SBF) flat or buy an HDB flat or EC from the resale market. Meanwhile, a SC and foreigner couple can also ballot for a BTO/SBF flat, but will only be limited to purchasing 2-room Flexi flats. For more information, you may refer to the HDB website for the guidelines.

Private Housing

Private housing in Singapore refers to residential properties that are owned and developed by private developers or individuals, as opposed to public housing that is built and managed by the Housing and Development Board (HDB) or the Urban Redevelopment Authority (URA). Private housing can take the form of apartments, condominiums, landed houses, and ECs, and is generally considered to be more upscale and luxurious than public housing.

Singapore has a welcoming policy towards foreign homebuyers, particularly in the private housing market, where fewer restrictions apply to their residency status. Unlike public housing, foreigners looking to purchase a private residential property are not limited by location, and their residency status will only affect the Additional Buyers’ Stamp Duty (ABSD) rates that they have to pay. They are also not subjected to the MOP before renting out or selling the properties they own in Singapore.

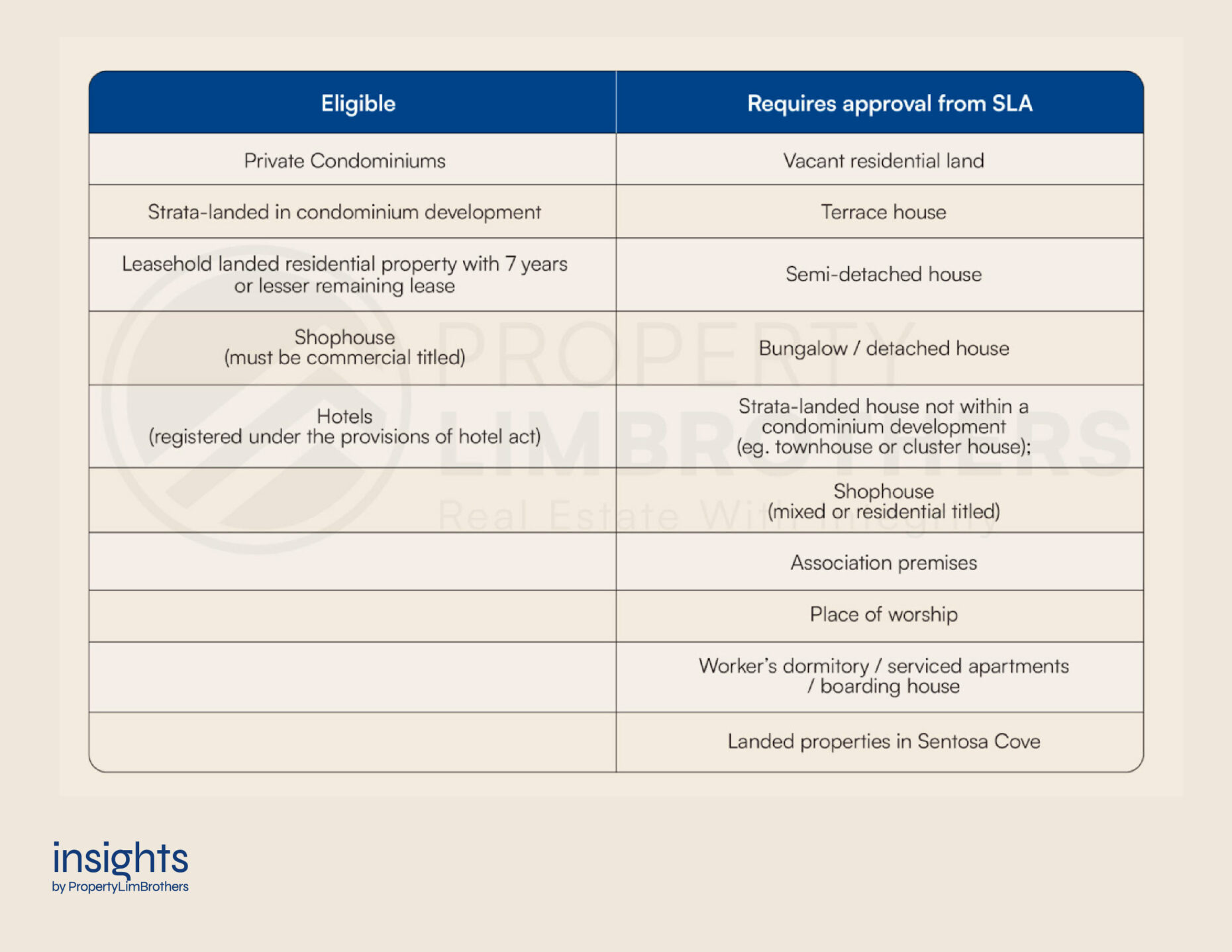

Below is a table that summarises the types of private residential properties that foreigners are eligible to purchase.

Foreign investors who are interested in purchasing landed properties in Singapore are required to first seek approval from the Land Dealings Approval Unit (LDAU) of the Singapore Land Authority (SLA).

The application process for approval is assessed on a case-by-case basis and takes into consideration several factors such as the applicant’s permanent residency status in Singapore for a minimum of five years and their economic contributions to the country, such as their employment income that is taxable in Singapore. The only way to bypass the approval process is by buying a leasehold landed property with seven years or less remaining lease. Such properties can be bought without SLA approval.

Coming to the restrictions, foreign buyers purchasing a landed residential property are restricted to those that do not exceed 15,000 sqft and are not located within a good class bungalow area. Those who wish to purchase such properties will be subject to much more stringent qualifying criteria.

On the other hand, the criteria for purchasing properties in Sentosa Cove are less stringent, albeit still requiring the LDAU’s approval. Foreign buyers only need to use the property solely for their own occupation and that of their family members as a dwelling house, and not for rental or any other purpose. The only limitation is that the property must not exceed 1,800 sqm in size.

Non-Residential Properties: Diversification of Portfolio

In recent years, Singapore has seen a growing interest in non-residential properties as a key investment opportunity for foreign investors. With a highly developed economy, stable political climate, and business-friendly environment, Singapore offers a wealth of opportunities for investors seeking to diversify their portfolios through non-residential property investments.

Non-residential properties in Singapore include a diverse range of asset classes such as commercial offices, retail spaces, commercial shophouses, industrial facilities, and hospitality properties. These properties offer investors a chance to tap into Singapore’s economy, which has seen consistent growth in recent years. Additionally, the government has implemented various policies and initiatives to support the growth of these sectors, such as the development of new business parks, improved infrastructure, and tax incentives.

One major advantage of investing in commercial and industrial properties is that the ABSD does not apply. Unlike residential properties, foreign investors purchasing commercial or industrial properties are not required to pay an initial ABSD, which is currently set at 30% of the purchase price for residential properties. In essence, this provision makes commercial and industrial properties in Singapore more accessible and appealing to foreign investors, as they are not required to factor in the significant ABSD costs in their investment decisions.

For more on the pros and cons of investing in commercial and industrial properties, do check out this article.

Closing Thoughts

In summary, Singapore offers a diverse range of properties that foreigners can purchase, including condominiums, landed homes, and commercial properties. While the process of buying a property as a foreigner in Singapore can be daunting with various restrictions and regulations in place, there are many resources available for you to do your research before making your property decisions.

If you have any questions about the process or would like guidance in navigating the market, we invite you to reach out to our PropertyLimBrothers team. Our experienced and knowledgeable team can provide you with the latest market trends and analyses, as well as advise you on whether your investment would be prudent and where the best opportunities lie.

We understand that investing in real estate can be a significant decision, and our team is committed to providing you with the support you need to make informed choices. Contact us today to learn more about how we can help you achieve your real estate goals in Singapore.