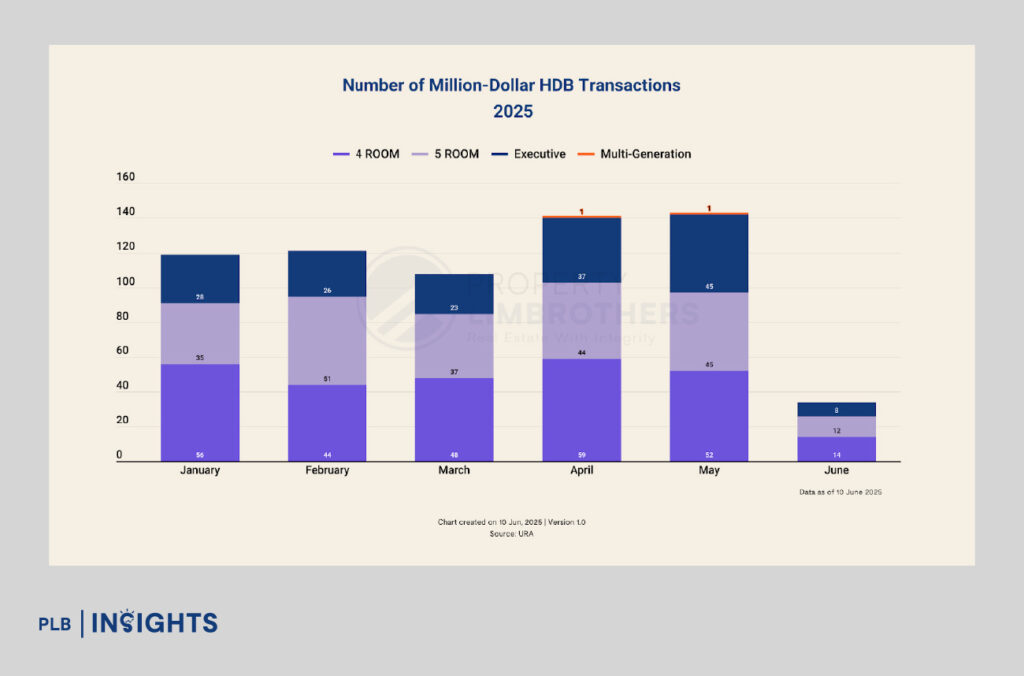

May 2025 marked a major milestone for Singapore’s public housing market. A record-breaking 143 HDB flats changed hands at $1 million or more, accounting for 6.3% of all resale transactions in a single month — the highest proportion on record. This reinforces a trend that’s been building over the last few years: million-dollar HDB flats are no longer anomalies — they’re becoming a recognisable asset class within the public housing landscape.

Million-Dollar HDBs Are Gaining Market Share

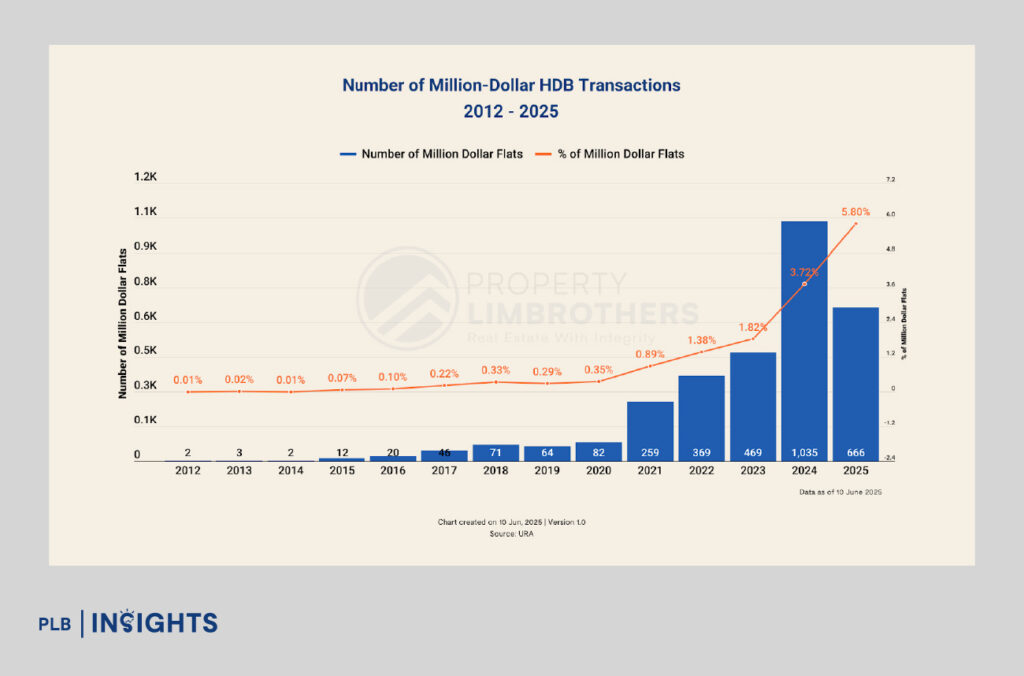

The rapid growth in million-dollar transactions has been anything but accidental. In 2021, only 0.89% of all HDB resale transactions crossed the million-dollar mark. Fast forward to 2025 (as of 10 June), that share has increased to 5.8% in the whole of 2024, and May’s figure alone hit 6.3%. These numbers confirm a structural shift in buyer behaviour — demand is rising for well-located, well-renovated, and lease-stable public flats.

As of 10 June 2025, we’ve already seen 666 such deals year-to-date, putting the market on track to surpass the 1,035 units recorded in 2024. If momentum continues, we may cross the 1,200-unit threshold by year-end — and that would be a 16% year-on-year increase.

Bigger Flats Continue to Drive the Luxury Segment

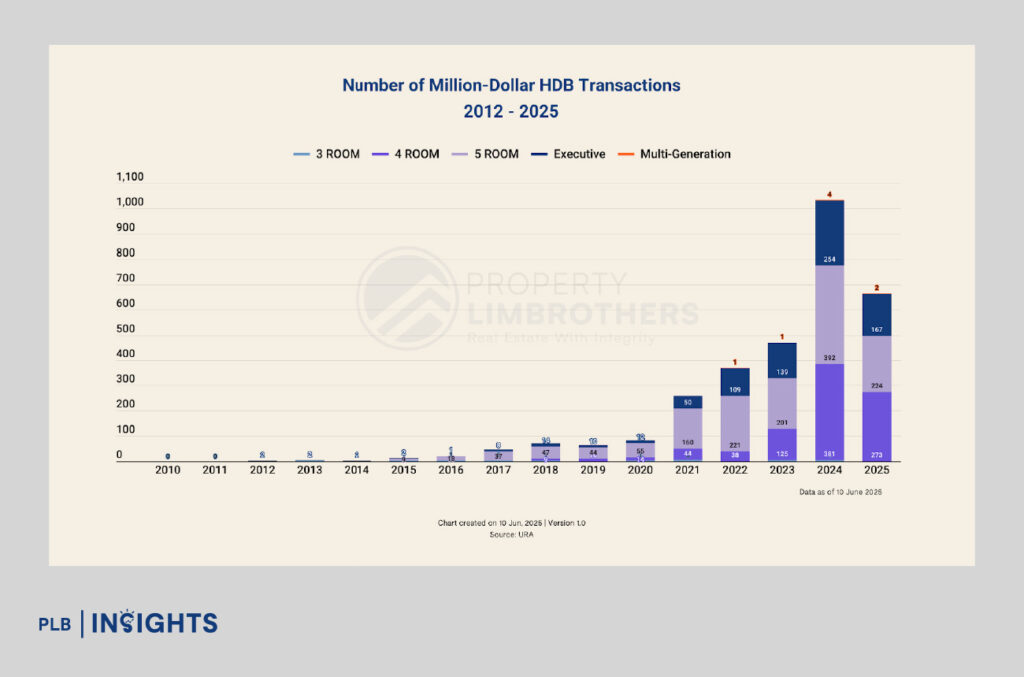

Looking at the unit breakdown, the million-dollar bracket was largely anchored by 5-room and executive flats. These units offer larger floor plates, functional layouts, and typically enjoy more open views or corner privacy — factors that drive their premium valuation.

But a closer look shows that 4-room flats are emerging as significant players today, particularly in city-fringe locations. Interestingly, in 2025 so far, there have been 273 four-room units sold for at least $1 million — slightly more than 5-room units (224) and well ahead of executive flats (167).

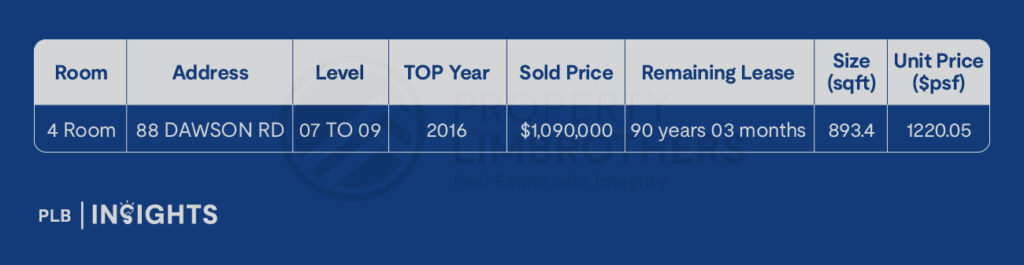

This trend reflects how location and remaining lease tenure can elevate even mid-sized units into the million-dollar range. A 4-room unit at SkyVille @ Dawson transacted recently at ~$1.1M. The price comes with a remaining lease of ~90 years, a high-floor stack with unblocked views, and premium renovations — demonstrating how the right attributes can elevate value.

4-Room Flats Dominate Overall Market Share

In terms of unit preference, 4-room flats remain the most transacted, accounting for 45% of all resale deals in May. Their popularity is supported by Singapore’s long-term demographic trends — with average household sizes shrinking to 3.09 persons in 2024 (down from 3.53 in 2000), the 4-room layout offers a sweet spot for space, affordability, and functionality.

3-room and 5-room flats are nearly evenly split at ~24% market share each, while executive flats made up 5.9% of transactions. Despite smaller volume, executive flats remain in high demand in the million-dollar bracket, offering rare size and layout combinations for larger families or those seeking long-term multigenerational living.

Dip in Resale Volume, but Value Concentration Is Rising

While prices have stayed firm, transaction volume fell slightly. There were 2,284 resale deals in May, a 1.1% drop from April, and 10% lower year-on-year. This softening is likely linked to Singapore’s General Election on May 3, which may have prompted some buyers to front-load purchases in April amid policy uncertainty.

What’s clear, though, is that the market has become more value-concentrated. Despite the volume dip, we saw an all-time high in million-dollar transactions, meaning a greater proportion of buyers are pursuing high-value, high-quality resale homes, rather than speculative or short-term flips.

Mature vs. Non-Mature: A Tale of Price vs. Volume

In terms of geography, non-mature estates accounted for 58.4% of all transactions, compared to 41.6% from mature estates. This is consistent with affordability dynamics, as non-mature towns like Sengkang, Punggol, and Yishun offer newer flats, longer leases, and competitive pricing — ideal for first-time buyers and upgraders.

However, when it comes to million-dollar transactions, mature estates continue to dominate. Towns such as Queenstown, Toa Payoh, Bukit Merah, and Kallang Whampoa remain hotspots, thanks to their centrality, limited supply, and high connectivity.

A notable example: a 5-room unit at City View @ Boon Keng transacted recently at $1.49 million in May 2025, demonstrating the premium buyers are willing to pay for flats with city views, proximity to MRT, and robust lease tenure.

Even then, a 5-room flat at Block 279B Sengkang, located near Buangkok MRT station, transacted at $1,058,000 in April this year, highlighting that non-mature estates are no longer exempt from the million-dollar trend — especially when location, amenities, and remaining lease align with buyer expectations.

What This Means for Buyers, Sellers, and the Market Ahead

The rising volume and share of million-dollar HDB transactions suggests a mature, bifurcated market, where affordability coexists with aspiration. Buyers are increasingly willing to pay for public flats that offer private-like qualities — size, location, and quality of life. Sellers of well-located large flats, especially in city-fringe areas, now enjoy strong pricing power, provided the units are well-renovated and competitively positioned.

Looking ahead, we anticipate that 2025 will set another record for million-dollar HDBs, and we may see new town entrants into this segment as infrastructure, schools, and transport networks continue to upgrade. Areas to watch include Bishan, Toa Payoh (central clusters), and selected parts of Bedok and Marine Parade, where lifestyle amenities intersect with ageing but lease-viable stock.

Check out some of PLB HDB Listings here!

https://www.propertylimbrothers.com/listings/?type=HDB

Stay Updated and Let’s Get In Touch

Questions? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.